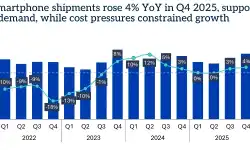

Price rally lifts 4Q25 DRAM revenue 29.4% QoQ

A sharp upswing in DRAM contract prices drove global industry revenue to USD 53.58 billion in the fourth quarter of 2025, up 29.4% sequentially, according to the latest analysis from TrendForce.

SCIP compliance: why data, not legislation, remains the real bottleneck

Five years after the introduction of the SCIP database, many electronics manufacturers still struggle to translate legal obligations into day-to-day practice. While the rules themselves are no longer new, uncertainty persists — not so much about what the law says, but about how to comply without turning regulatory work into a permanent administrative burden.

R&D in Switzerland: structure, scale and the role of electronics

Switzerland is regularly described as one of the world’s most innovative economies. In the Global Innovation Index, the country has repeatedly ranked first, ahead of much larger industrial nations. This position reflects a combination of high R&D intensity, strong patent activity and a dense network of research-performing companies. Yet these aggregate indicators say relatively little about how innovation is structured in practice, and even less about the position of electronics within the Swiss economy.

Sponsored content by Würth Elektronik eisos

Efficient thermal management for electronic components

Effective thermal management is essential to ensure the reliability and longevity of electronic systems. Würth Elektronik provides advanced thermal interface materials - gap fillers and heat spreaders - that enhance heat transfer and support stable system performance.

Infineon: GaN market to reach USD 3 billion by 2030

German semiconductor manufacturer Infineon Technologies expects the gallium nitride (GaN) power semiconductor market to reach nearly USD 3 billion by 2030, according to the 2026 edition of its annual “GaN Insights” report.

Europe losing ground in semiconductor research

Research and development in semiconductor technology is increasingly taking place outside Europe, particularly in Asia, according to a new analysis by EconPol Europe.

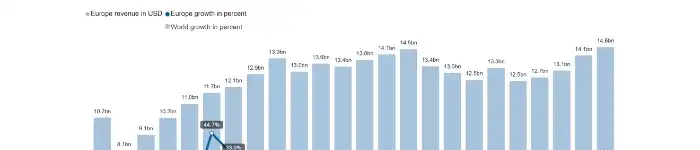

Global semiconductor sales reach record high in 2025

Global semiconductor sales climbed to a record USD 791.69 billion in 2025, marking a 26.1% increase compared with the previous year, according to figures released by the European Semiconductors Industry Association (ESIA). In Europe, semiconductor sales reached USD 54.46 billion during the year, up 6.2% YoY.

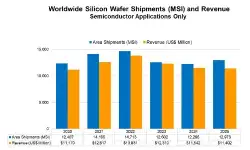

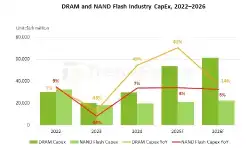

AI boom set to push memory revenues far beyond foundry market by 2026

The ongoing AI-driven investment cycle is expected to lift global semiconductor revenues to new highs by 2026, with the memory market growing to more than twice the size of the wafer foundry industry, according to new data from market research firm TrendForce.

Finland’s R&D model and its role in the electronics industry

In a recent analysis, Evertiq explored which countries dominate global R&D spending. Viewed through the lens of absolute investment volumes, the picture is largely shaped by the United States and China, followed by established industrial powerhouses such as Germany, Japan and France. Shifting that lens away from global heavyweights and toward a smaller, highly R&D-intensive economy reveals a different dynamic — one where the relationship between research investment and industrial capability becomes more clearly defined. Finland provides a useful case for understanding how research investment translates into industrial capability.

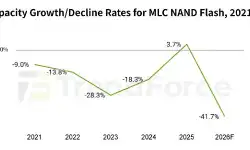

DRAMpocalypse: Memory price projections skyrocket for 1Q26

The global memory market is heading toward historically sharp price increases in the first quarter of 2026, according to a new forecast from market research firm TrendForce.

Who is the leader in R&D spending?

For years, the global technology narrative seemed simple: the United States led in innovation, while China was primarily seen as the world’s manufacturing floor. But that picture has been changing rapidly, almost in real time. As competition between Washington and Beijing increasingly centres on technology and strategic industries, a key question emerges: do the numbers actually reflect this shift? Has China truly caught up with — or even overtaken — the United States in research and development spending? And how does the broader global ranking look beyond this high-profile rivalry?

Load more news

.jpg)