SEMI: Global chip equipment billings up 21% in Q1 2025

Global semiconductor equipment billings reached USD 32.05 billion in the first quarter of 2025, marking a 21% increase compared to the same period in 2024, according to the latest Worldwide Semiconductor Equipment Market Statistics (WWSEMS) report published by SEMI.

Despite the annual growth, billings declined 5% compared to the previous quarter, in line with typical seasonal trends.

SEMI attributed the YoY growth to continued investments in semiconductor manufacturing capacity, driven by strong demand related to AI and ongoing global fab expansion efforts.

The industry continues to navigate challenges related to geopolitical tensions, trade policy uncertainty, and export controls, but SEMI noted that long-term investment activity remains strong.

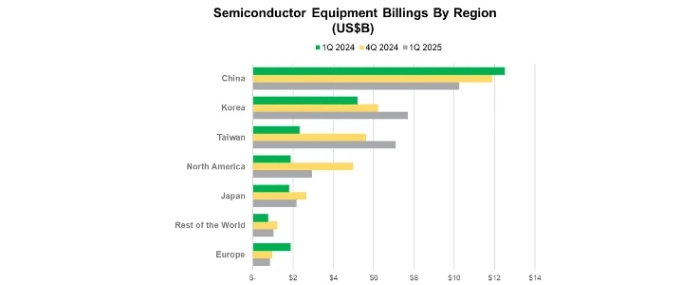

| Region | 1Q 2025 | 4Q 2024 | 1Q 2024 | 1Q (QoQ) | 1Q (yOY) |

| China | $10.26 | $11.88 | $12.52 | -14% | -18% |

| Korea | $7.69 | $6.22 | $5.20 | 24% | 48% |

| Taiwan | $7.09 | $5.63 | $2.34 | 26% | 203% |

| North America | $2.93 | $4.98 | $1.89 | -41% | 55% |

| Japan | $2.18 | $2.66 | $1.82 | -18% | 20% |

| Rest of the World | $1.03 | $1.22 | $0.76 | -15% | 36% |

| Europe | $0.87 | $0.97 | $1.86 | 11% | -54% |

| Total | $32.05 | $33.56 | $26.42 | -5% | 21% |

(USD billions)

“The global semiconductor equipment market began 2025 with a solid quarter that reflects future-looking investments in vital chipmaking capacity across regions,” says Ajit Manocha, SEMI President and CEO, in a press release. “With the ongoing AI boom continuing to drive fab expansions and equipment sales, the industry is showing resilience in the face of uncertainty around geopolitical tensions, tariff volatility and export controls. SEMI is actively engaging with governments to advocate for policy stability essential to multi-billion-dollar fab investments, including equipment, and the long-term success of advanced manufacturing operations.”