Semiconductor foundry landscape to transform by 2030

Market intelligence and analyst firm Yole Group explores the status of the semiconductor foundry in its latest report – digging deep into the geopolitical, economic, and capacity realignments setting the stage for the foundry industry.

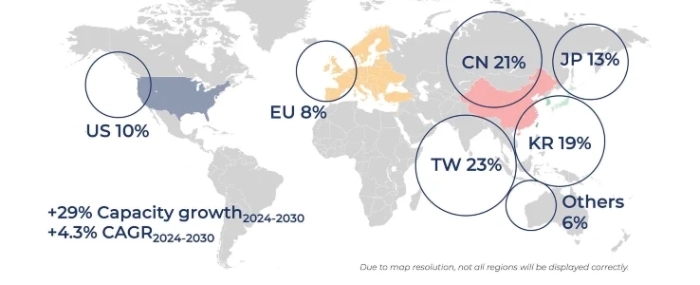

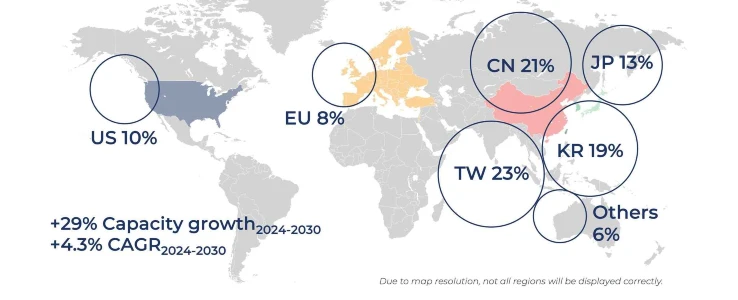

The global semiconductor foundry market is on the verge of a significant structural change, according to Yole Group. In its newly released “Status of the Semiconductor Foundry Industry report,” the analyst firm projects foundry capacity to expand at a 4.3% CAGR between 2024 and 2030 – however, this growth walks hand in hand along increasingly geopolitical tension.

Yole’s findings highlight a clear difference between where capacity is being built, and where demand actually comes from. Let’s take the US for example, which represents 57% of global wafer demand, at the same time they own just 10% of foundry capacity domestically. On the other side of the coin we have China, which is responsible for only 5% of wafer demand, and held 21% of global foundry capacity in 2024 – and is on track to reach 30% by 2030.

“The foundry market is more of a capitalistic game than a product competition,” says Pierre Cambou, Principal Analyst, Global Semiconductors at Yole Group, in a press release. “Ownership, location, and utilization must now be read through national interests, economic security, and long-term technology strategy.”

The fact that Asia is a dominant force in the semiconductor space hardly comes as a suprice, but when jus list the numbers it becomes rather painfully obvious.

The report that Taiwan, with foundry giants such as TSMC, UMC, and VIS, controls 23% of global capacity despite accounting for just 4% of wafer demand. Similarly, South Korea – championed by Samsung – maintains an even balance, holding 19% each of capacity and demand.

According to Yole, Europe and Japan are holding steady in terms of the supply-demand balance, though much of their foundry capacity is tied to their own internal market. However, Yole notes that Southeast Asia, particularly Singapore and Malaysia, remains heavily reliant on foreign-owned facilities, holding 6% of global capacity with limited local players.

As capacity investments accelerate globally, fueled by government subsidies and national security concerns, Yole cautions that utilisation rates may struggle to keep up. Foundry utilistion is expected to hover around 70% through 2030 – and this relatively low utilisation rate is according to the analyst firm set to become the new normal.

Without a surge in wafer production and end-market demand, the return on these capital-intensive expansions may fall short.

China ramps up

While US-based companies still control roughly 20% of global capacity, 10% locally and 10% abroad, China’s homegrown players are rapidly expanding own local capacity from 15% in 2024 to significantly more by 2030.

“This growing divergence between where capacity is built and who owns it points to future uncertainties in market access, supply chain transparency, and strategic leverage,” Yole writes.

The current, geographical overweight toward Asia, will according to the Analyst firm only deepen. The future of the semiconductor foundry landscape will be shaped less by technological edge alone, and more by ownership structures, geopolitical leverage, and regional self-sufficiency strategies.

The report concludes that the semiconductor foundry industry is entering a decisive decade; where the path forward will be driven much more by the demand-side dynamics than by the investment capacity, which is already overwhelming.