The European electronics industry risks falling behind

Key segments of the EU's electronics manufacturing industry are set to decline – undermining Europe’s security, industrial resiliency, and global competitiveness.

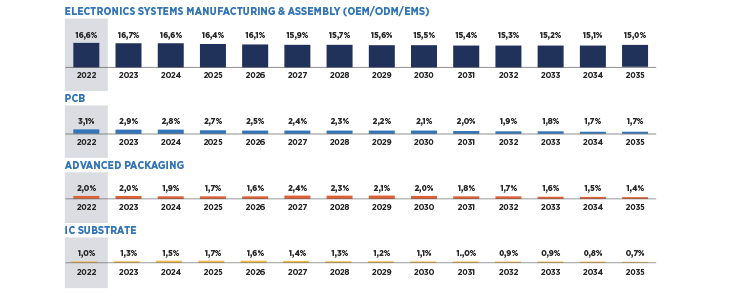

A recent analysis by IPC reveals Europe's increasing reliance on foreign regions for electronics manufacturing in critical and strategic sectors such as aerospace and defence. Even with the adoption of the European Chips Act, the report – Securing EU’s Electronics Ecosystem – shows that the EU’s market share in critical electronics components other than chips, such as PCBs, electronic manufacturing services EMS, and advanced packaging, will fall to 15% by 2035. Evertiq has previously reported on the challenging situation the European industry is facing – especially the PCB industry.

Over the previous two decades, the PCB industry in Europe has seen a severe decline, one could even call it an erosion. In passing the Chips Act, the EU made a strategic, but narrowly crafted commitment to the electronics industry – but rebuilding a robust and sustainable European electronics ecosystem requires revitalising and expanding electronics production beyond chips.

According to the IPC, a "silicon to systems" strategy is required – even necessary – to support ongoing EU technological leadership and achieve strategic objectives.

As previously reported, US and European PCB manufacturers have been outcompeted and outpaced over the last couple of decades by Asian PCB manufacturers. In 2000, Europe's domestic PCB manufacturing accounted for 16% of the global total; by 2022, this figure had dropped to 2.3%. Back in 2000, Europe had 555 PCB manufacturers, in 2015 this number had been reduced to 247 – in 2021 it had dropped to 171.

Given the current trajectory of the European PCB industry, Evertiq has invited Alun Morgan, President of EIPC, to participate as a keynote speaker at the Evertiq Expo in Berlin, Germany on June 20, 2024, to talk about the dire situation that the industry faces.

IPC’s investigative report examines just how reliant Europe is on non-EU manufacturing in eight strategic sectors including aerospace/defence, automation, mobility, healthcare, and renewable energy – and the picture it portrays is far from pleasant.

According to the IPC research, for each of these eight strategic sectors, several similar storylines emerge. First, without strategic initiatives and policies, the EU's total share of electronics systems manufacturing is expected to drop by 2035. Second, the EU continues to rely heavily on overseas suppliers for critical inputs and processes such as PCBs, advanced packaging, and IC substrates. Third, without intentional and strategic interventions, these dependencies are bound to intensify by 2035.

According to the IPC’s data, the EU’s share of the global PCB industry is 2.8% as of 2024, and by 2035, the IPC projects it to be 1.7% – assuming nothing is done to slow current development.

A comparable scenario for electronics system manufacturing and assembly (OEM/ODM/EMS) may be drawn. The EU now has a 16.6% global share, but as previously indicated, if nothing changes, the IPC predicts this proportion will be 15% in 2035.

The study's findings echo growing calls for strategic investments and broad policies to boost the EU's competitiveness. If the EU truly wants to “reduce its strategic dependencies in sensitive sectors” it needs to look beyond chips.

The industry now calls for action, global PCB production has more than doubled since 2000 with European demand today at an estimated EUR 7.87 billion – while at the same time, the PCB production in the EU is valued at roughly USD 2 billion, or around 2% of global production.

The IPC states that despite soaring demand for PCBs, European PCB production is projected to satisfy only 11% of European demand for PCBs – down from 17.5% today.

The answer, according to the IPC, is a Strategic Electronics Manufacturing Act (SEMA), building on the model of the European Chips Act and broadening the approach to include the full electronics manufacturing value chain.

As mentioned earlier, Evertiq has invited Alun Morgan, President of EIPC, to participate as a keynote speaker at the Evertiq Expo in Berlin, Germany on June 20, 2024, to shine the spotlight on the European PCB industry.

Additionally, Evertiq has assembled industry professionals for a panel discussion where we will delve deeper into the challenges and opportunities of the European electronics industry. The aim is not only to discuss critical topics but also to share insights and solutions that can help the industry as a whole thrive in this dynamic environment. By fostering a collaborative dialogue, we hope to inspire innovation, resilience, and a shared vision for the future of the European electronics industry.

.jpg)