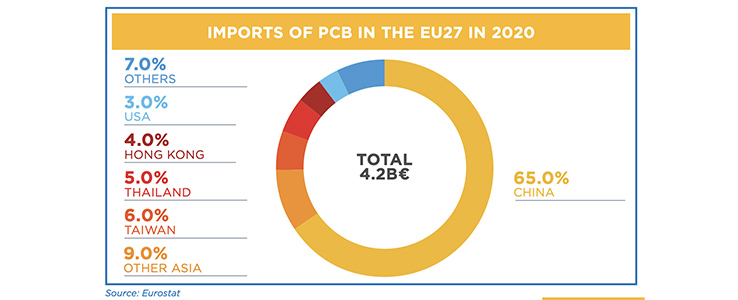

65% of all imported PCBs in Europe come from China

In passing the Chips Act, the EU made a strategic, but narrowly crafted commitment to the electronics industry. But what about PCBs?

The Chips Act aims to strengthen the region’s position within the global semiconductor landscape. However, the EU is not alone in looking to boost its level of innovation and manufacturing of semiconductors.

The industry's dependence on overseas semiconductor production has been a particular worry for the US government. Similar to this, the European Union identified semiconductors as something necessary for its own "technological sovereignty". But it’s not only the US and EU that are looking to boost their domestic semiconductor industry, China, South Korea and Japan are also investing capital to secure and build up their capabilities.

The pandemic, geopolitical events and the subsequent semiconductor shortage have made governments throughout the world more aware of the importance of local production, and semiconductors have emerged as a strategic resource. And while important – semiconductors alone can not make up a system.

While chips are undoubtedly essential components of electronics, the near singular focus on the semiconductors industry has – as the IPC puts it – obscured the critically important segments of the broader electronics ecosystem, including PCB fabrication and electronic assembly (EMS).

As previously reported by Evertiq, the European PCB industry has over the past 20 years experienced a notable decline in its capacities, capabilities, and global market share, despite its importance. Meanwhile, the European EMS sector offers tremendous, but unrealised, growth potential.

“The EU only accounts for 2.3% of global PCB production and 11.5% of electronic assembly. Revitalizing and growing these segments is essential to building a robust European electronics manufacturing ecosystem to ensure industrial resiliency, advance the twin transitions, and promote European innovation,” the IPC writes in a recent report on EU industrial policy.

Two-thirds of the PCBs imported to Europe originate from China

IPC estimates that yearly PCB production in the EU is valued at roughly USD 2 billion, or around 2% of global production. This is a stark contrast to the 1990s when the EU commanded about 20-30% of global production. Today, there are less than 180 PCB manufacturing facilities in the EU and the region's dependence on China has only increased over time. According to IPC's research, China now accounts for some 65% of total EU PCB requirements.

European PCB manufacturers have, as a result of the outsourcing, become rather specialised manufacturers. This specialisation focuses on products with very high added value, often very complex, have high delivery speed requirements, or have high reliability and quality requirements. This has in turn resulted in a high mix of products – that are often supplied in low volume.

The semiconductor shortage highlighted just how vulnerable both the US and Europe are without sufficient domestic production capacity, as well as how dependent the regions are on Asian capacity. The US later realised that this also extends to PCBs and introduced the Protecting Circuit Boards and Substrates Act of 2023 – aiming to finish the job the Chips Act started by incentivising investment in the domestic PCB industry.

The bill will bring forth USD 3 billion to fund factory construction, workforce development and R&D, as well as a 25% tax credit for purchasers of American-made PCBs and substrates. There is currently no equivalent to this bill in Europe.

It’s been said before but it bears repeating; if the EU truly wants to have “technological sovereignty” as a whole, PCBs need to be viewed for what they are, a fundamental element in electronic systems – and the industry needs support.

Given the current trajectory of the European PCB industry, Evertiq has invited Alun Morgan, President of EIPC, to participate as a keynote speaker at the Evertiq Expo in Berlin, Germany on June 20, 2024, to talk about the dire situation that the industry faces.

In his presentation, he will review macroeconomics highlighting current and upcoming global risk factors before focusing on the European PCB market and trends. European Purchasing Managers' Indices will be discussed along with technology and market trends before concluding with global and European business outlook.