The European PCB industry – a trip down memory lane

European PCB production has for a number of years been outcompeted and outperformed by production in Asia. It’s been previously documented that the prime movers were price competition and a strong outsourcing wave of the entire electronics industry in general. But how does the European PCB industry look today?

During EIPC’s summer conference in Örebro Sweden, EIPC President Alun Morgan took to the stage to paint a picture of the industry as it was, and where we currently are.

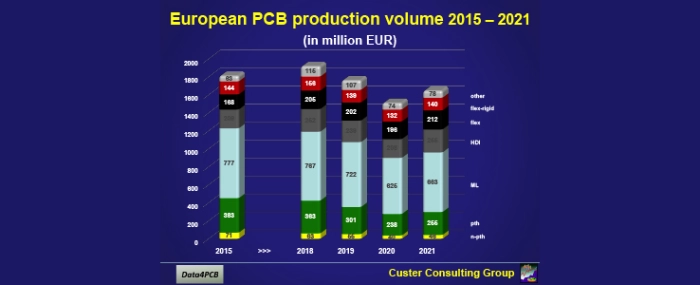

Leaning on a presentation from Custer Consulting Group – with supporting data from PCB industry expert Michael Gasch of Data4PCB – Mr. Morgan presented the highs and lows of the manufacturing PCB industry in Europe.

The earliest data point in the presentation is 2015, a time when Europe had a total of 247 PCB manufacturing companies. In 2021 that number had been reduced to 171. However, it is worth pointing out that while the number of producing companies has dwindled some -30.7%, the actual revenues when comparing the industry back 2015 and 2021 have only been reduced by -9.2%.

| Summary | 2015 | >> | 2018 | 2019 | 2020 | 2021 | 20/21 Change |

| Revenues (million EUR) | 1.815 | 1.921 | 1.764 | 1.513 | 1.648 | +8,9% | |

| Staff | 16.491 | 16.642 | 15.783 | 14.989 | 15.361 | +2,5% | |

| Number of manufacturers per company size | |||||||

| < EUR 2 million | 109 | 66 | 43 | 56 | 57 | ||

| EUR 2 – 10 million | 98 | 84 | 101 | 80 | 77 | ||

| EUR 10 – 50 million | 34 | 46 | 37 | 31 | 32 | ||

| > EUR 50 million | 6 | 6 | 6 | 5 | 5 | ||

| Total | 247 | 202 | 187 | 172 | 171 | ||

Source: Data4PCB / Custer Consulting Group

Looking at the European PCB production for 2021 Germany sticks out – unsurprisingly – as biggest European producer, holding 43% of the market. Austria and Switzerland together hold 19.6% of the market, while Italy holds 11.7%.

| Production (EUR million) | % of Europe | |

| Germany | 709,0 | 43.0% |

| Austria + Switzerland | 322,0 | 19.6% |

| Italy | 193,7 | 11.7% |

| Great Britain | 139,6 | 8.5% |

| Belgium + France | 123,3 | 7.5% |

| Central Europe | 83,2 | 5.0% |

| Spain | 40,1 | 2.4% |

| Rest of Europe | 36,5 | 2.2% |

Source: Data4PCB / Custer Consulting Group

Over the years, the actual revenues from PCBs produced in Europe have decreased. Europe recorded more revenues back in 2015 than it did in 2021 – with a high point in 2018. Although, the volume did increase in 2021 when compared to 2020, as is illustrated in the top picture.

When looking at the biggest industrial segments for European PCB manufacturers industrial electronics is one of the major ones, representing 19,6% of the market. Besides industrial electronics – which is the strongest segment in Europe – the region is also strong in Medical (9,8%), Special types (8,7%), Automotive (8,7%), Defence (8,0%) and Mobility (6,2%).

Michael Gasch provided comments on the data stating that “based on the sales result for the first four months in 2022 the total potential growth in Europe could be between 7 and 9%.”

According to the PCB industry expert, German-speaking countries may see growth between 6% and 7%. France, Belgium, Span and Italy could grow as much as 9–10% while Central Europe could see growth between 10–13%

With this in mind, Michael Gasch believes that Europe reach a total volume of 1,750 to 1,800 million EUR this year – which would be on the same level as 2015.

However, there are a few red flags to be mindful of.

2021 was a rebound year for the electronics industry showing growth throughout many sectors. The early part of 2022 had signs of continued growth on a lower level.

In the presentation, Michael Gasch says that, with the continuation of the Russian war with Ukraine, China’s COVID restrictions, the rising cost of materials and energy, and supply chain challenges; our situation is obviously not improving. This is likely to continue well into 2022 and even further into the start of 2023.

On a brighter note though, recent inflation pressure is causing interest rates to rise, this may cause a slowdown in demand and we may see some stabilisation. Semiconductors are expected to remain strong with double-digit growth. PCB growth should be around 5–8%.