© mikhail mishchenko dreamstime.com

Analysis |

Top-10 semiconductor suppliers continue to grow in Q2

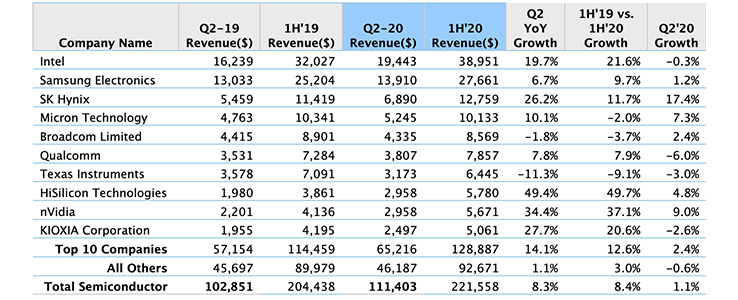

Building on Q1’s bullish growth in weak market conditions, the world’s top-10 semiconductor suppliers managed to continue their revenue growth at a rate of 2.4% in Q2 2020, PC and server sales continue to grow driven by COVID lockdown restrictions as working and learning from home are becoming the new norm.

Additional revenue growth has been enabled by aggressive inventory strategies by OEM’s in anticipation of second half holiday sales. The Total semiconductor market grew by 1.1%, sequentially. While, the top-10 chipmakers collectively generated revenue of USD 65.2 billion in the second quarter of 2020.

“The top-10 semiconductor companies continue to control more of the semiconductor market. They have gained nearly 3 percentage points share of the total market versus the same time last year (55.6% to 58.5%). Even more impressive is the six-month growth rate of the top – 10 versus the same period last year, up by 12.6% compared to only 3% for the non top – 10,” says Ron Ellwanger, senior research analyst at Omdia.

Memory-oriented semiconductors continued to grow rapidly with PC and data center demand continuing to drive Memory revenues in Q2 2020. DRAM revenues were up by 15.9% with overall memory ICs revenues growing by 10.1%. NAND revenues also grew in Q2 as a result of SSD demand, with revenues increasing by 4.9% quarter on quarter. This memory ICs total revenue growth was partly driven by the increase in average selling prices for both DRAM and NAND.

Omdia’s Competitive Landscaping Tool (CLT) service identifying the market growth in semiconductor suppliers. For more information, visit © Omdia.

Revenue in millions USD

Michael Yang, research director manufacturing components at Omdia, added: “In 1H20, hyperscale data centers resumed its buildout and the demand for DRAM significantly ramped up compared to a year ago. The server DRAM module ASPs surge started in 1Q20 and continued to ascend in 2Q20, powering the DRAM market to USD 16.8 billion in revenue.” SK Hynix and nVidia Lead growth amongst the top 10 Whilst memory continued to dominate the growth rate for the top-10, especially SK Hynix, Nvidia was the second highest growing revenue in Q2 2020 achieving 9% growth due to increased demand in the server, cloud and gaming markets. While Intel saw growth in their Data Center and Memory Groups the remainder of their businesses narrowly declined, resulting in a mere 0.3% decrease in quarterly revenues. Major players such as Intel, Qualcomm and Texas Instruments all saw their revenues decrease in Q2. Qualcomm’s quarterly revenues decreased by 6% as a result in focusing on the high-end smartphone market for Q2. Whilst Texas Instruments revenues dropped by 3.0% due to a global slowdown within the automotive industry. Outside of the automotive industry revenue growth for TI was a positive. Kevin Anderson ‘Practice Lead | Power, Automotive and Industrial Semiconductors’ at Omdia, mentioned: TI’s non-automotive semiconductor revenue gained 6% in the quarter, capitalizing on the at-home trends driving more device sales and infrastructure growth, the growth in medical devices and a positive industrial quarter as companies-maintained inventory positions to hedge against any supply chain disruptions.” Top-10 Market Share Movement There were no changes in the ranking of the first nine semiconductor companies in Q2’20. The only change was KIOXIA, formerly known as Toshiba Memory, supplanted Infineon in the top 10 rankings for Q2 despite having a 2.6% loss in revenue in the quarter. Infineon fell out of the top 10 semiconductor companies after a decline of 10.1 percent in revenue in Q2. Infineon’s revenue decline was mainly due to their automotive segment. The total automotive semiconductor segment continues to suffer from the impact of COVID, declining 20.9 percent in Q2’20.Omdia’s Competitive Landscaping Tool (CLT) service identifying the market growth in semiconductor suppliers. For more information, visit © Omdia.