© IC Insights

Analysis |

Revenue per wafer climbs as demand surges

The success and proliferation of integrated circuits has largely hinged on the ability of IC manufacturers to continue offering more performance and functionality for the money. But despite high development costs, smaller nodes bring greater revenue per wafer.

Driving down the cost of ICs (on a per-function or per-performance basis) is inescapably tied to a growing arsenal of technologies and wafer-fab manufacturing disciplines as mainstream CMOS processes reach their theoretical, practical, and economic limits.

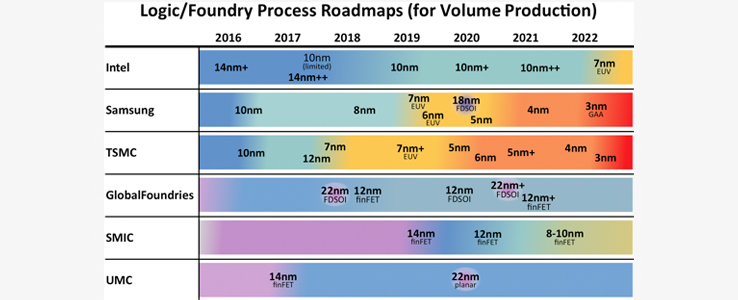

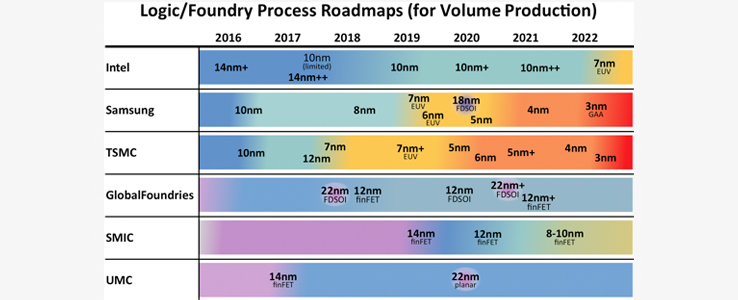

Data presented in IC Insights’ 2021 edition of The McClean Report notes that many fabless IC companies are clamoring to have their leading-edge devices, including high-performance microprocessors, low-power application processors, and other advanced logic devices, fabricated using 7nm and 5nm process nodes. Some of the current iterations from logic and foundry suppliers are shown in the image below.

Note: What defines a process ”generation” and the start of ”volume” production varies from company to company, and may be influenced by marketing embelishment, so these points of transition should only be seen as very general guidelines.

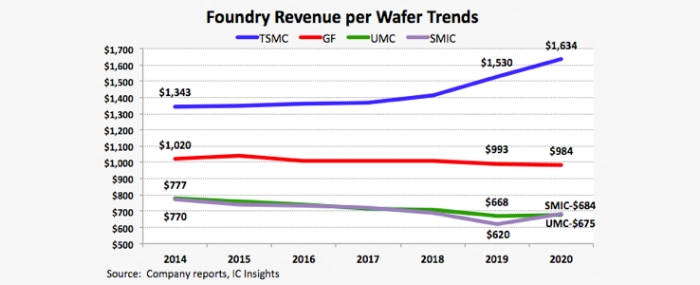

In the foundry world, particularly, manufacturing with leading-edge processes carries a distinct advantage. In 2020, TSMC was the only pure-play foundry manufacturing ICs using both 7nm and 5nm process nodes. Not coincidentally, its overall revenue per wafer increased significantly in 2020 as many of the top fabless IC suppliers—16 fabless IC companies with more than USD 1.0 billion in 2020 revenue—lined up to have their newest designs manufactured using these most advanced processes. Three of the four pure-play foundries enjoyed higher revenue-per-wafer in 2020 (GlobalFoundries’ revenue per wafer slipped 1% last year). TSMC’s figure of USD 1,634 exceeded GlobalFoundries by 66% and was more than double the revenue per wafer value at UMC and SMIC. With estimated capital expenditures of USD 27.5 billion in 2021, TSMC will expand its available capacity at these nodes and also begin risk production of 3nm ICs this year with 3nm volume production slated to start in 2022.

Besides foundry and logic IC manufacturing, memory suppliers like Samsung, Micron, SK Hynix, and Kioxia/WD are using advanced processes to make their DRAM and flash memory components. No matter the device type, the IC industry has evolved to the point where only a very small group of companies can develop leading-edge process technologies and fabricate leading edge ICs. Growing design and manufacturing challenges and costs have divided the integrated circuit world into the haves and have-nots. Marketshare makeup in various IC product segments has become “top heavy,” with increasing shares held by the top producers, leaving very little room for remaining competitors.

Note: What defines a process ”generation” and the start of ”volume” production varies from company to company, and may be influenced by marketing embelishment, so these points of transition should only be seen as very general guidelines.

In the foundry world, particularly, manufacturing with leading-edge processes carries a distinct advantage. In 2020, TSMC was the only pure-play foundry manufacturing ICs using both 7nm and 5nm process nodes. Not coincidentally, its overall revenue per wafer increased significantly in 2020 as many of the top fabless IC suppliers—16 fabless IC companies with more than USD 1.0 billion in 2020 revenue—lined up to have their newest designs manufactured using these most advanced processes. Three of the four pure-play foundries enjoyed higher revenue-per-wafer in 2020 (GlobalFoundries’ revenue per wafer slipped 1% last year). TSMC’s figure of USD 1,634 exceeded GlobalFoundries by 66% and was more than double the revenue per wafer value at UMC and SMIC. With estimated capital expenditures of USD 27.5 billion in 2021, TSMC will expand its available capacity at these nodes and also begin risk production of 3nm ICs this year with 3nm volume production slated to start in 2022.

Besides foundry and logic IC manufacturing, memory suppliers like Samsung, Micron, SK Hynix, and Kioxia/WD are using advanced processes to make their DRAM and flash memory components. No matter the device type, the IC industry has evolved to the point where only a very small group of companies can develop leading-edge process technologies and fabricate leading edge ICs. Growing design and manufacturing challenges and costs have divided the integrated circuit world into the haves and have-nots. Marketshare makeup in various IC product segments has become “top heavy,” with increasing shares held by the top producers, leaving very little room for remaining competitors.

For more information visit © IC Insights

Note: What defines a process ”generation” and the start of ”volume” production varies from company to company, and may be influenced by marketing embelishment, so these points of transition should only be seen as very general guidelines.

In the foundry world, particularly, manufacturing with leading-edge processes carries a distinct advantage. In 2020, TSMC was the only pure-play foundry manufacturing ICs using both 7nm and 5nm process nodes. Not coincidentally, its overall revenue per wafer increased significantly in 2020 as many of the top fabless IC suppliers—16 fabless IC companies with more than USD 1.0 billion in 2020 revenue—lined up to have their newest designs manufactured using these most advanced processes. Three of the four pure-play foundries enjoyed higher revenue-per-wafer in 2020 (GlobalFoundries’ revenue per wafer slipped 1% last year). TSMC’s figure of USD 1,634 exceeded GlobalFoundries by 66% and was more than double the revenue per wafer value at UMC and SMIC. With estimated capital expenditures of USD 27.5 billion in 2021, TSMC will expand its available capacity at these nodes and also begin risk production of 3nm ICs this year with 3nm volume production slated to start in 2022.

Besides foundry and logic IC manufacturing, memory suppliers like Samsung, Micron, SK Hynix, and Kioxia/WD are using advanced processes to make their DRAM and flash memory components. No matter the device type, the IC industry has evolved to the point where only a very small group of companies can develop leading-edge process technologies and fabricate leading edge ICs. Growing design and manufacturing challenges and costs have divided the integrated circuit world into the haves and have-nots. Marketshare makeup in various IC product segments has become “top heavy,” with increasing shares held by the top producers, leaving very little room for remaining competitors.

Note: What defines a process ”generation” and the start of ”volume” production varies from company to company, and may be influenced by marketing embelishment, so these points of transition should only be seen as very general guidelines.

In the foundry world, particularly, manufacturing with leading-edge processes carries a distinct advantage. In 2020, TSMC was the only pure-play foundry manufacturing ICs using both 7nm and 5nm process nodes. Not coincidentally, its overall revenue per wafer increased significantly in 2020 as many of the top fabless IC suppliers—16 fabless IC companies with more than USD 1.0 billion in 2020 revenue—lined up to have their newest designs manufactured using these most advanced processes. Three of the four pure-play foundries enjoyed higher revenue-per-wafer in 2020 (GlobalFoundries’ revenue per wafer slipped 1% last year). TSMC’s figure of USD 1,634 exceeded GlobalFoundries by 66% and was more than double the revenue per wafer value at UMC and SMIC. With estimated capital expenditures of USD 27.5 billion in 2021, TSMC will expand its available capacity at these nodes and also begin risk production of 3nm ICs this year with 3nm volume production slated to start in 2022.

Besides foundry and logic IC manufacturing, memory suppliers like Samsung, Micron, SK Hynix, and Kioxia/WD are using advanced processes to make their DRAM and flash memory components. No matter the device type, the IC industry has evolved to the point where only a very small group of companies can develop leading-edge process technologies and fabricate leading edge ICs. Growing design and manufacturing challenges and costs have divided the integrated circuit world into the haves and have-nots. Marketshare makeup in various IC product segments has become “top heavy,” with increasing shares held by the top producers, leaving very little room for remaining competitors.

For more information visit © IC Insights