AI boom set to push memory revenues far beyond foundry market by 2026

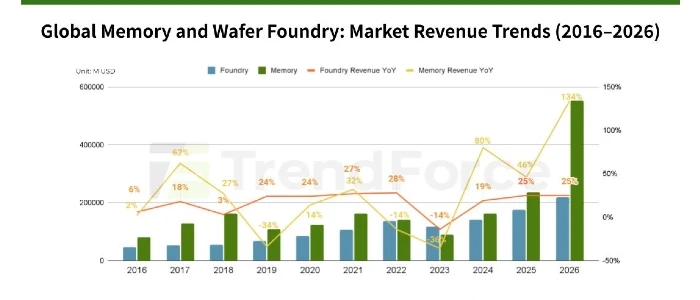

The ongoing AI-driven investment cycle is expected to lift global semiconductor revenues to new highs by 2026, with the memory market growing to more than twice the size of the wafer foundry industry, according to new data from market research firm TrendForce.

TrendForce estimates that total memory market revenue will reach USD 551.6 billion in 2026, driven by tight supply conditions and sharply rising prices. By comparison, global foundry revenue is forecast to reach USD 218.7 billion, also a record level but far behind memory in absolute scale.

The widening gap reflects what TrendForce describes as a new memory “supercycle,” underpinned by AI-related demand that differs structurally from previous upswings.

AI reshape memory demand

Unlike the memory supercycle of 2017–2019, which was largely driven by cloud data centre expansion, the current cycle is shaped by the rapid shift of AI workloads from model training toward large-scale inference. This transition places greater emphasis on real-time responsiveness and fast data access, sustaining demand for high-capacity and high-bandwidth DRAM in servers.

TrendForce also points to growing demand for enterprise SSDs, supported by Nvidia's promotion of its Vera Rubin platform. To manage cost while maintaining performance, cloud operators are expected to expand their use of high-capacity QLC SSDs for data-intensive AI workloads.

A notable difference from earlier cycles is the buyer profile. Instead of end-device manufacturers, hyperscale cloud service providers (CSPs) are now driving demand.

As previously reported by Evertiq, memory prices are already projected to surge further in the first quarter of 2026, reflecting persistent supply-demand imbalances across key product segments.

Foundry revenues grow at a steadier pace

While wafer foundries are also benefiting from strong AI-related demand, particularly for advanced-node logic used in AI accelerators, their revenue growth is generally steadier compared to the memory industry.

TrendForce attributes this to structural characteristics of the foundry business. Although advanced nodes command high unit prices, they account for only around 20–30% of total foundry capacity. Mature nodes, which represent roughly 70–80% of capacity, continue to dominate output and limit the overall revenue impact of advanced processes.

In addition, foundry pricing is largely governed by long-term contracts, which reduces price volatility. This contrasts sharply with the memory market.

Structural differences favour memory suppliers

TrendForce also highlights differences in capacity expansion between the two sectors. Memory production is based on a more standardised product mix and generally requires fewer mask layers than logic manufacturing. This allows memory suppliers to convert capital expenditure into output more efficiently than pure-play foundries, which must support a wide range of process technologies, particularly at mature nodes.

With AI-driven demand continuing to grow and supply shortages unlikely to ease in the near term, memory suppliers are likely to retain strong pricing power. Under these conditions, the research firm projects that memory revenue growth will outpace that of the wafer foundry industry through 2026.

.jpg)