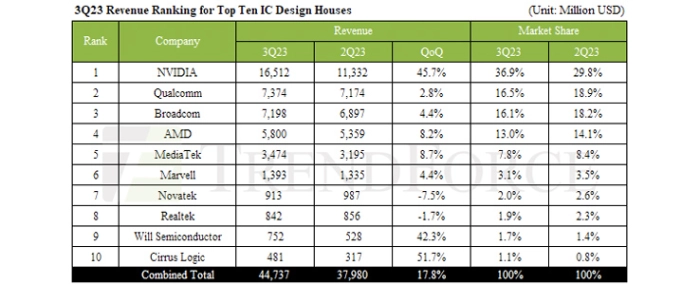

Top 10 IC design houses to see 17.8% increase in quarterly revenue in 3Q23

TrendForce reports that 3Q23 has been a historic quarter for the world’s leading IC design houses as total revenue soared 17.8% to reach a record-breaking USD 44.7 billion.

This growth is fueled by a robust season of stockpiling for smartphones and laptops, combined with a rapid acceleration in the shipment of generative AI chips and components. NVIDIA, capitalizing on the AI boom, emerged as the top performer in revenue and market share. Notably, analog IC supplier Cirrus Logic overtook US PMIC manufacturer MPS to snatch the tenth spot, driven by strong demand for smartphone stockpiling.

NVIDIA’s revenue soared 45.7% to USD 16.5 billion in the third quarter, bolstered by sustained demand for generative AI and LLMs. Its data centre business – accounting for nearly 80% of its revenue – was a key driver in this exceptional growth.

Qualcomm, riding the wave of its newly launched flagship AP Snapdragon 8 Gen 3 and the release of new Android smartphones, saw its third-quarter revenue climb by 2.8% QoQ to around USD 7.4 billion. However, NVIDIA’s rapid growth eroded Qualcomm’s market share to 16.5%. Broadcom, with its strategic emphasis on AI server-related products like AI ASIC chips, high-end switches, and network interface cards, along with its seasonal wireless product stockpiling, managed to offset weaker demand in server storage connectivity and broadband. This strategic maneuvering led to a 4.4% QoQ revenue boost to USD 7.2 billion.

AMD witnessed an 8.2% increase in its 3Q revenue, reaching USD 5.8 billion. This success was due to the widespread adoption of its 4th Gen EPYC server CPUs by cloud and enterprise customers and the favourable impact of seasonal laptop stockpiling. MediaTek's revenue rose by 8.7% to USD 4.4 billion in the third quarter, buoyed by a healthy replenishment demand for smartphone APs, WiFi6, and mobile/laptop PMIC components, as inventories across brand clients stabilised.

Cirrus Logic ousts MPS from tenth position thanks to smartphone inventory replenishment

Marvell also made significant gains, with its third-quarter revenue hitting USD 1.4 billion, a 4.4% QoQ increase. This growth was primarily driven by increasing demand for generative AI from cloud clients and the expansion of its data centre business – despite declines in sectors like enterprise networking and automotive. However, the outlook for some sectors remains mixed, with areas like TV and networking still facing uncertainties, leading to a cautious approach from clients. This resulted in some IC design companies, such as Novatek and Realtek, witnessing a decline in revenues by 7.5% and 1.7%, respectively.

Will Semiconductor benefited from the demand for Android smartphone components, breaking free from past inventory corrections with a 42.3% increase in 3Q revenue to USD 752 million. Cirrus Logic, similarly capitalising on the smartphone component stockpiling trend, saw a significant 51.7% jump in revenue to USD 481 million, ousting MPS from the top ten.

In summary, TrendForce forecasts sustained growth for the top ten IC design houses in the upcoming fourth quarter. This optimistic outlook is underpinned by a gradual normalisation of inventory levels and a modest seasonal rebound in the smartphone and notebook market. Additionally, the global surge in LLMs extends beyond CSPs, internet companies, and private enterprises, reaching regional countries and small-to-medium businesses, further bolstering this positive revenue trend.

This ranking only includes the top ten companies that publicly disclose their financial reports.

This ranking considers Qualcomm's revenues solely from its QCT division, excludes OEM/IP revenues for NVIDIA, includes only semiconductor division revenues for Broadcom and counts only semiconductor design and sales revenues for Will Semiconductor.

.jpg)