Geopolitical shifts reshape the semiconductor landscape

Taiwan's foundry, assembly and test shares are forecasted to drop to 43% and 47%, respectively, in 2027, according to market intelligence provider IDC.

Following the introduction of the chip acts and semiconductor policies in several different countries, semiconductor firms have been compelled to prepare "China + 1" or "Taiwan + 1" production plans. This transformation has resulted in a new global layout for the foundry and assembly/test industries, resulting in regional expansion in the semiconductor industrial chain, IDC states in a recent report, revealing significant shifts in the world of semiconductors.

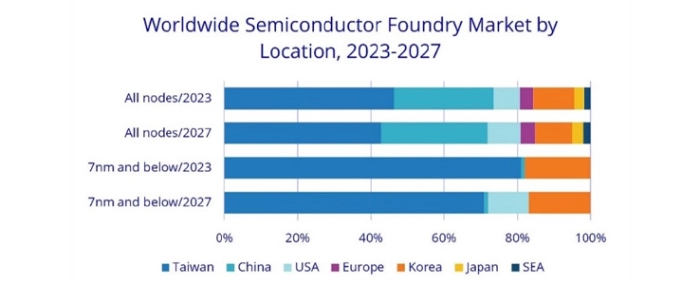

Strategic movement can be seen by major industry players. In terms of foundry, TSMC, Samsung, and Intel are leading the way in advanced processes in the US, which will eventually exercise influence in the foundry area.

"Geopolitical shifts are fundamentally changing the semiconductor game. While immediate impacts might be subtle, long-term strategies are focusing more on supply chain self-reliance, security, and control. The industry operation will move from global collaborations to multi-regional competitions. says Helen Chiang, Asia Pacific semiconductor research lead and Taiwan country manager in a press release.

Meanwhile, even as China struggles with the development of advanced processes, its mature processes have grown significantly as a result of local demand and national policies. IDC states in the report that based on the categorisation by production location, China's proportion of overall industrial areas will continue to increase, reaching 29% in 2027, an increase of 2% from 2023, and Taiwan's market share will fall from 46% in 2023 to 43% in 2027. The US is expected to make some advances in the advanced process segment, and its share of 7nm and below is predicted to reach 11% by 2027.

IDC points out that given the influence of geopolitics, technological advancement, and talent, major integrated device manufacturers (IDM) in the United States and Europe have started to invest more in the Southeast Asia market, and OSAT companies have started to shift their focus away from China to Southeast Asia in terms of semiconductor assembly and test.

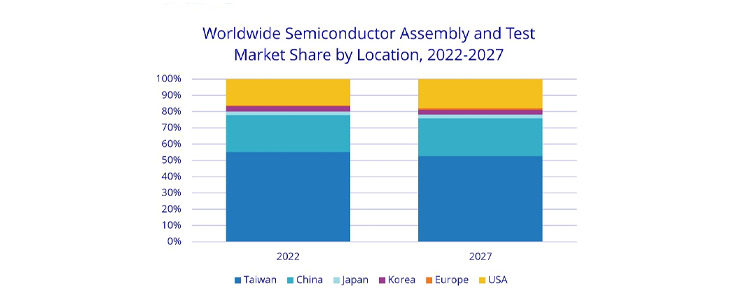

As a result, it is anticipated that Southeast Asia will become a more significant player in the semiconductor assembly and test market, particularly in Malaysia and Vietnam, which will be the major regions deserving of special focus in the field's future growth. In 2027, Southeast Asia is expected to account for 10% of the world's semiconductor assembly and testing, while Taiwan's share will fall to 47% from 51% in 2022.