DRAM and NAND Flash demand expected to increase in 2024

TrendForce expects that memory suppliers will continue their strategy of scaling back production of both DRAM and NAND Flash in 2024, with the cutback being particularly pronounced in the financially struggling NAND Flash sector.

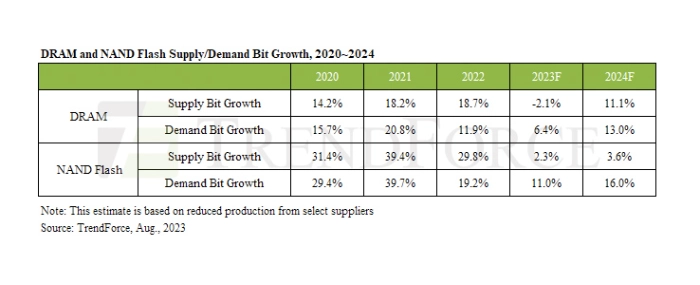

Market demand visibility for consumer electronic is projected to remain uncertain in 1H24. Additionally, capital expenditure for general-purpose servers is expected to be weakened due to competition from AI servers. Considering the low baseline set in 2023 and the current low pricing for some memory products, TrendForce anticipates YoY bit demand growth rates for DRAM and NAND Flash to be 13% and 16%, respectively. Nonetheless, achieving effective inventory reduction and restoring supply-demand balance next year will largely hinge on suppliers’ ability to exercise restraint in their production capacities. If managed effectively, this could open up an opportunity for a rebound in average memory prices.

PC: The annual growth rate for average DRAM capacity is projected at approximately 12.4%, driven mainly by Intel’s new Meteor Lake CPUs coming into mass production in 2024. This platform’s DDR5 and LPDDR5 exclusivity will likely make DDR5 the new mainstream, surpassing DDR4 in the latter half of 2024. The growth rate in PC client SSDs will not be as robust as that of PC DRAM, with just an estimated growth of 8–10%. As consumer behavior increasingly shifts toward cloud-based solutions, the demand for laptops with large storage capacities is decreasing. Even though 1 TB models are becoming more available, 512 GB remains the predominant storage option. Furthermore, memory suppliers are maintaining price stability by significantly reducing production. Should prices hit rock bottom and subsequently rebound, PC OEMs are expected to face elevated SSD costs. This, when combined with Windows increasing its licensing fees for storage capacities at and above 1 TB, is likely to put a damper on further growth in average storage capacities.

Servers: The annual growth rate for the average capacity of server DRAM is estimated to reach 17.3%. This surge is primarily fueled by generational transitions in server platforms, a heightened dependency on RAM that is coordinated with CPU cores in specific CSP operations, and the high computational load requirements of AI servers. Enterprise SSDs: The estimated annual growth rate of average capacity stands at 14.7%. For CSPs, the rollout of processors supporting PCle 5.0 suggests that inventory levels for these OEMs should return to normal by early next year, likely prompting an uptick in the procurement of 8 TB products. On the brand side for servers, while the sharp decline in NAND Flash prices is propelling an increase in 16 TB deployments, the contribution of AI servers to this growth remains relatively limited.

Smartphones: The annual production growth rate for smartphones in 2024 is estimated to be a modest 2.2%, largely impacted by a global economic downturn. TrendForce cites this as the primary reason for the sluggish growth in demand volume. Thanks to multiple consecutive quarters of declining memory prices, brands are increasingly focusing on hardware competition. Consequently, the average DRAM memory capacity in smartphones is projected to rise by approximately 14.3% in 2023. Given that the ASP of mobile DRAM is expected to remain at a relatively low point in 2024, this trend is likely to persist, potentially leading to an additional 7.9% growth in average device memory capacity for the year.

UFS & eMMC: Factors such as growing demand for image storage and increased 5G penetration are expected to drive up the average storage capacity in smartphones. However, as suppliers scale back production to set the stage for potential price hikes, smartphone OEMs are projected to exercise greater caution in cost management in 2024, potentially leading to fewer mid-to-low-end models offering over 1TB of storage. On a related note, the absence of enthusiasm for QLC products among smartphone OEMs likely presents an obstacle for suppliers aiming to nudge consumers toward capacity upgrades via lower-cost options. With smartphone storage baselines continually rising and given Apple's current lack of plans to introduce iPhone models exceeding 1TB of storage, TrendForce anticipates that the annual growth rate for average smartphone storage capacity will hover around 13% in 2024.

For more information visit Trendforce.