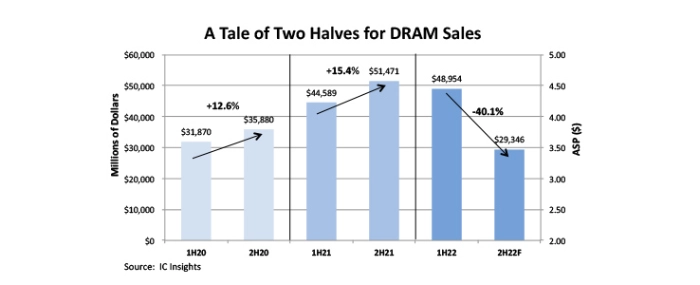

A tale of two halves for DRAM market

The DRAM market often enjoys robust sales in the second half of the year when system makers place orders for memory to use in their new generation of products that they plan to release for the year-end holiday season. That scenario has not panned out this year.

Weakening economic conditions and high inflation rates have slowed global demand for personal computers, mainstream smartphones, and other consumer electronics. As a result, DRAM demand has spiraled downward and sales are now forecast to fall -40% to USD 29.3 billion in the second half of 2022 compared to USD 49.0 billion in 1H22. For all of 2022, the DRAM market is forecast to fall by 18%.

The DRAM market enjoyed robust sales during the first several months of the year, before the first signs of a significant DRAM market correction began to appear in late 2Q22. Micron, for example, reported an 11% increase in its fiscal 3Q22 sales (ending in May). A looming market collapse was not evident in its quarterly sales results but then the company dropped a bomb by giving sales guidance of -17% for its fiscal fourth quarter (ending in August). Micron’s actual 4Q22 sales fell -23%, much more than its guidance. Late in the year, Micron also said that it expected its annual DRAM bit volume to fall -1%, giving further evidence of the rapid and severe downturn in the DRAM market.

SK Hynix ( 23%) and Samsung (-20%) also announced steep declines in their 3Q22 memory sales and both expect DRAM market softness to continue through the end of this year and at least into 1Q23.

The big three memory makers noted in their earnings conference calls that inflation had put a dent in consumer discretionary spending, at a time of year when sales normally heat up. Add ongoing supply chain disruptions and bloated inventory levels and a DRAM market correction was almost unavoidable.

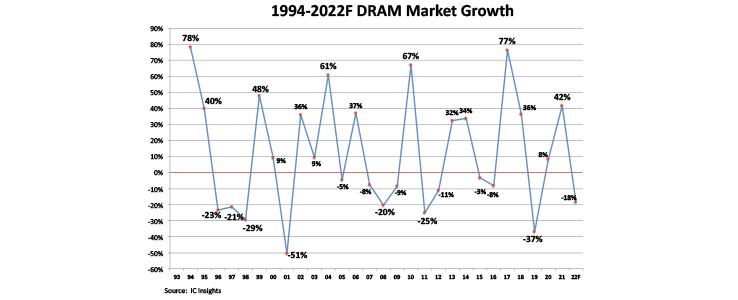

Over the past 30 years, the DRAM market has been characterized by periods of spectacular growth and years of devastating crashes (like 2022) as evidenced by the saw-tooth “curve”.

In just the past four years, the DRAM market has experienced a decline of -37% in 2019, a 42% increase in 2021, and a decline of 18% is forecast for 2022. With such extreme volatility, it is little wonder that the number of DRAM suppliers has decreased from more than 25 30 years ago, to three major suppliers today.

For more information visit IC Insights

.jpg)