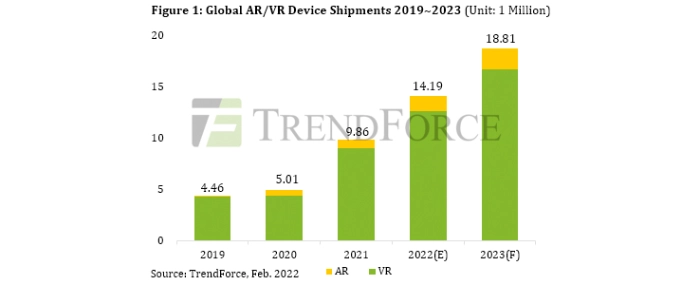

AR/VR device shipments to reach 14.19 million units in 2022

AR/VR device shipments revised up to 14.19 million units in 2022, with an annual growth rate of 43.9%, according to TrendForce research.

Growth momentum will come from increased demand for remote interactivity stemming from the pandemic, as well as Oculus Quest 2’s price reduction strategy. Microsoft HoloLens 2 and Oculus Quest 2 are first in market share for AR and VR, respectively.

According to TrendForce, the topic of the Metaverse has driven brands to actively plan for and stimulate product shipment performance. However, the AR/VR device market has yet to experienced explosive growth due to two factors: component shortages and the difficulty of developing new technologies. In addition, cosmetic and size considerations have made the more optically and technically difficult Pancake design the first choice for new high-end products. Furthermore, various embedded tracking feedback technologies key to enhancing the user's immersive experience such as eye tracking and 6DoF further affect the development progress of a new product as a whole. Since there are no new foreboding products on the horizon, TrendForce believes, no other branded products have a chance at supplanting the current mainstream status of Oculus or Microsoft until at least 2023.

The Oculus Quest 2, which costs between USD 200 and USD 400, is currently the most popular AR/VR device in the consumer market. TrendForce expects Oculus to launch an advanced version of the Quest product within two years, reaching a hardware performance equivalent of USD 700 or down to a retail price of USD 500 with discounts. This product is expected to expand the size of the high-end consumer AR/VR market. The commercial market is dominated by the HoloLens 2 which costs more than USD 1,000 and upwards of USD 3,500. Since the commercial market places more emphasis on the benefits of hardware and software integration, manufacturers that dominate commercial systems, software, and platforms have the advantage. Thus, Apple has become another focus in the AR/VR device market.

Strong shipments of Oculus and Microsoft products will likely force Apple to release relevant products to join the competition this year. However, TrendForce states, considering hardware performance requirements and gross profit margins, Apple will likely target the commercial market and adopt the same pricing strategy as HoloLens, hardware priced in the thousands of dollars and a monthly subscription-based software solution. Overall, TrendForce believes that the launch of new products this year by Apple, Meta, and Sony may be delayed and will not add significant growth to the overall AR/VR market for the time being.

For more information visit TrendForce