Sensor/actuator and discrete sales surge in 2021

Shortages, tight supplies, and higher prices drive up most O-S-D products in the economic rebound while CMOS image sensor sales are muted by U.S.-China disputes and softness in some systems, IC Insights says report.

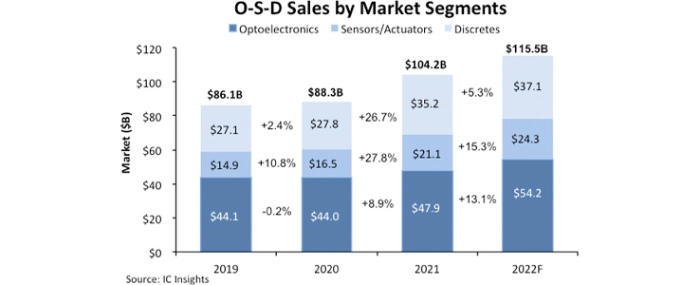

Worldwide sales of optoelectronics, sensors and actuators, and discrete semiconductors (O-S-D) each climbed to record-high levels during the 2021 global economic rebound from the Covid-19 virus crisis and lockdowns aimed at slowing the spread of the deadly pandemic. According to IC Insights total O-S-D revenues crossed USD 100 billion for the first time ever in 2021, growing 18% to USD 104.2 billion compared to USD 88.3 billion in 2020, when combined sales in the three markets increased by less than 3% as the virus first took hold.

O-S-D sales—which accounted for 17% of the world’s USD 613.9 billion total semiconductor market in 2021 (the rest being ICs)—were primarily driven last year by sharp increases in unit demand for widely used discrete devices, tight supplies of sensors and actuators, higher average selling prices (ASPs), long lead times for deliveries, and delays in restocking factory inventories by system makers, according to IC Insights.

Fueled by purchases of power transistors, diodes, and many commodity devices, total discrete semiconductor sales surged 27% in 2021—more than 5x the annual average growth rate in the last three decades—to USD 35.2 billion. Meanwhile, revenues climbed 26% in 2021 for sensors (including pressure and microphone chips, accelerometers and gyroscope devices, magnetic-field sensors and compasses, and temperature sensors), and actuators sales jumped by 31% last year. The total sensor/actuator market grew 28% in 2021 to a record-high USD 21.1 billion, according to data in the recently released report.

Optoelectronics sales growth was muted in the 2021 rebound due to the lack of a surge in CMOS image sensors, which were held back by trade frictions and technology disputes between the U.S. and China, fluctuations in some key end-use applications, and shortages of ICs and other components used in digital-imaging systems. Optoelectronics sales increased 9% in 2021 to a record-high $47.9 billion, and the large CMOS image sensor category only grew 6% to USD 20.3 billion last year, says the January report.

IC Insights now forecasts that total O-S-D sales will increase 11% in 2022 to USD 115.5 billion with optoelectronics rising 13% to USD 54.2 billion, sensors/actuators expanding 15% to USD 24.3 billion, and the discretes segment easing back to more normal growth of 5% to USD 37.1 billion this year.

For more information visit IC Insights.