© TPCA

PCB |

Global PCB Top100: Bigger gets bigger and faster

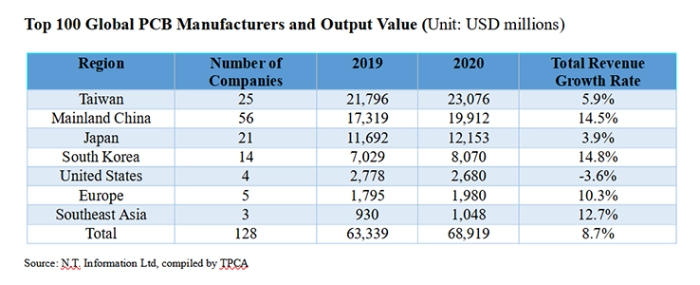

Compared with last year's list, the number of companies in each region is 56 in China (+4), 25 in Taiwan (-2), 21 in Japan (+3), 14 in South Korea (+2), 4 in the United States (same), 5 in Europe (same), and 3 in Southeast Asia (-1).

The report also indicated that more than half of the world's top PCB manufacturers and production value are located in mainland China

For the 2020 report, a special investigation was conducted on the number of PCB manufacturers and production clusters worldwide, which concluded that there are about 2,100 PCB manufacturers in the world with a combined total of 2,687 plants, of which 1,480 are concentrated in China, accounting for 55% of global manufacturing plants.

When cross-referenced with the latest available data from the Industrial Technology Research Institute (ITRI), about 53.2% of the global PCB production value in 2020 was produced in mainland China.

In recent years, the electronic industry has been affected by the U.S.-China trade war and the ongoing COVID-19 pandemic, prompting companies to accelerate the evaluation of diversification in production bases. However, for major global PCB players, China's PCB industry offers a major highly integrated global supply chain cluster and an enormous market, with market and industry characteristics that are not easily replicated in other countries that quickly. Therefore, mainland China will continue to remain the world's largest PCB production cluster in the short term.

Evolution of terminal products pushes upgrade of PCB industry

The top 25 companies accounted for 59.3% of the total output value among the companies on the list. This indicates that major players have continued to dominate the PCB industry, corresponding to the terminal applications and PCB product development trends. In the past decade, with the advent of IoT technology and increasing market demand for high performance and diverse electronic products, PCB manufacturing has shifted from standardised, mass-produced terminal applications such as home appliances, PCs, and mobile devices to niche, low volume, yet diverse end-use applications, such as for electric cars, wearable devices, etc.

As the required upgrade to manufacturing capabilities and cutting-edge technology continues to rise and evolve, it is driving a wave of new investment plans and huge demand for technology upgrades. Take the most in-demand PKG substrate products in today's market as an example: at present, global substrate manufacturers are mainly from Taiwan, Japan and Korea, with major players including Unimicron, Ibiden, SEMCO, Nan Ya PCB, Kinsus, Shinko and Simmtech, which are all in the top 25 list.

To maintain their leading positions, top-tier companies target new product design trends, invest in high-end manufacturing technology, and deploy effective production strategies.

Key product trend development analysis: Substrate have become most In-Demand product

Last year, as Apple launched the iPhone 12 in the traditional peak season in the third quarter, it created a huge spike in demand, benefitting the likes of Zhen Ding Technology Holding, Compeq, Flexium, DSBJ, Nippon Mektron, and Fujikura, etc. The demand for notebooks, tablet PCs, and game consoles was boosted by the remote work and education opportunities associated with the COVID-19 pandemic. Related motherboard makers such as HannStar Board, GCE, and Tripod Technology also performed well last year.

In the automotive electronics segment, although the global epidemic and chip shortage at one point overcast the global car market in 2020, with the market trend of electric vehicles and self-driving cars becoming even more apparent, related application manufacturers such as Chin Poon, Unitech, Dynamic Electronics, Meiko, CMK, Ellington, Kyoden, Shirai Denshi and others have felt the recovery of the car market and expect the global supply and demand imbalance for the automotive industry to be resolved as soon as possible.

As for the biggest winners in 2020, substrate manufacturers are expected to benefit most from the strong demand for chips in the global market, with the expansion and investment momentum of the substrate manufacturers also gaining pace. Major players such as Unimicron, Nan Ya PCB, Kinsus, Zhen Ding Technology Holding, Ibiden, Daeduck Electronics, AT&S, Shinko Denki, and DSBJ, etc., are all actively preparing for substrate -related investments in recent years.

The supply side is expected to release new production capacity to relieve the dilemma of product shortages. Despite the entry of new competitors, the substrate segment has entry barriers such as high technology, high quality and high capital requirements, and substrate manufacturers are expected to have great growth potential in the next 3-5 years.

In competition for high-end manufacturing processes, big gets bigger and faster

This year's NTI100 2020 Global Top 100 PCB Makers and Industry Dynamics Report indicates that in recent years, major players in Taiwan, Japan, and Korea have increased investment momentum in substrate to maintain a leading edge, while mainland manufacturers have also begun to catch up in the substrate segment buoyed by state policy support.

The requirements of cutting-edge technology and huge investment scale have created a competitive moat, prompting the gap between major companies and medium-sized companies on the list to continue to widen. However, in the face of the global pressure of net zero carbon emissions, large plants will be the first to bear the brunt. The development of carbon neutral manufacturing capabilities is the next key issue for large plants.

PCB is an indispensable component of electronic products. With stable and significant market demand, a large number of medium-sized PCB companies can catch the trend of diversification of electronic products, make good use of core advantages such as quality, delivery, cost control, production layout, and keep an eye on the technological progress of large manufacturers to remain profitable. It is expected that these medium-sized players will continue to play a pivotal role in the global top 100 and remain a source of vitality in the global PCB industry.

The complete "NTI-100 in 2020: Global Top 100 PCB Rankings and Industry News " report will be published in TPCA's 93rd quarterly magazine and TPCA's website.

The complete "NTI-100 in 2020: Global Top 100 PCB Rankings and Industry News " report will be published in TPCA's 93rd quarterly magazine and TPCA's website.