© IC Insights

Analysis |

China to fall far short of its ‘Made in China 2025’ goals for ICs

IC Insights forecasts China-produced ICs will represent only 19.4% of its IC market in 2025, a fraction of the Made in China 2025 goal of 70%.

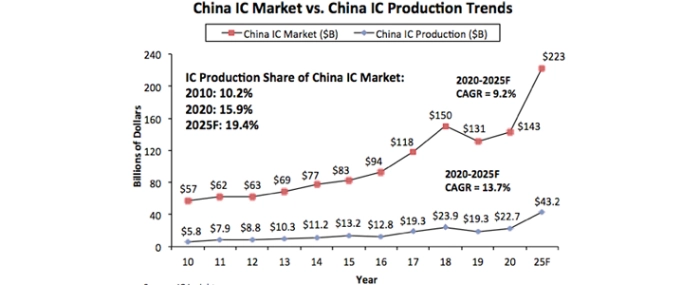

A very clear distinction should be made between the IC market in China and indigenous IC production in China. As IC Insights has oftentimes stated, although China has been the largest consuming country for ICs since 2005, it does not necessarily mean that large increases in IC production within China would immediately follow. As shown in graph above, IC production in China represented 15.9% of its USD 143.4 billion IC market in 2020, up from 10.2% 10 years earlier in 2010. Moreover, IC Insights forecasts that this share will increase by 3.5 percentage points from 2020 to 19.4% in 2025 (a 0.7 percentage point per year gain on average).

Of the USD 22.7 billion worth of ICs manufactured in China last year, China-headquartered companies produced only USD 8.3 billion (36.5%), accounting for only 5.9% of the country’s USD 143.4 billion IC market. TSMC, SK Hynix, Samsung, Intel, UMC, and other foreign companies that have IC wafer fabs located in China produced the rest. IC Insights estimates that of the USD 8.3 billion in ICs manufactured by China-based companies, about USD 2.3 billion was from IDMs and USD 6.0 billion was from pure-play foundries like SMIC.

If China-based IC manufacturing rises to USD 43.2 billion in 2025 as IC Insights forecasts, China-based IC production would still represent only 7.5% of the total forecasted 2025 worldwide IC market of USD 577.9 billion. Even after adding a significant markup to some of the Chinese producers’ IC sales (many Chinese IC producers are foundries that sell their ICs to companies that re-sell these products to the electronic system producers), China-based IC production would still likely represent only about 10% of the global IC market in 2025.

Currently, IC production in China is forecast to exhibit a very strong 2020-2025 CAGR of 13.7%. However, considering that China-based IC production was only USD 22.7 billion last year, this growth is starting from a relatively small base. In 2020, SK Hynix, Samsung, Intel, TSMC, and UMC were the major foreign IC manufacturers that had significant IC production in China.

Even with new IC production being established by China memory startups YMTC and CXMT, IC Insights believes that foreign companies will be a large part of the future IC production base in China. As a result, IC Insights forecasts that greater than 50% of IC production in China in 2025 will come from foreign companies such as SK Hynix, Samsung, TSMC, and UMC with fabs in China.