© TrendForce

Analysis |

Despite rebounding DRAM spot prices, downward pressure may persist in 2H20

Spot prices have risen for certain types of memory chips recently, leading to significant market speculations on whether the entire memory industry could see a turnaround in the near future.

TrendForce’s current observations of the DRAM market indicate that consumer DRAM accounts for only 8% of the overall DRAM market’s bit consumption. As such, even though consumer DRAM prices have been fluctuating, movements in contract prices of DRAM products will generally be dictated by changes in the inventory levels of suppliers and buyers and by the recovery of purchasing momentum for mainstream server DRAMs. DRAM prices will be under downward pressure until data centers and buyers of enterprise servers restart their inventory-building procurement. Hence, the recent rebound in spot prices is likely a mere temporary phenomenon.

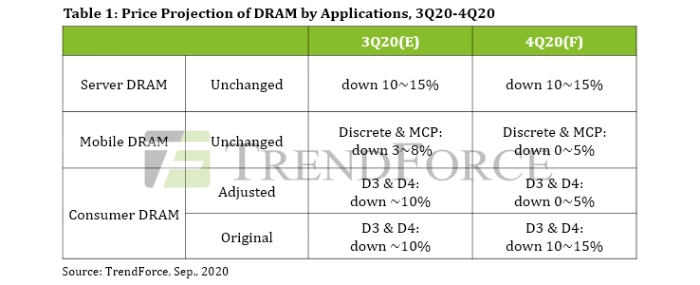

Consumer DRAM has the strongest demand momentum as its QoQ decline in 4Q20 is expected to narrow down to within 5%

Driven by expanded sanctions from the U.S., Huawei has recently intensified its procurement for DRAM products in anticipation of potential shortages after the grace period deadline. Under these circumstances, *16 chips that are mainstream in the consumer DRAM segment are going to be very much sought after because of the demand coming from 5G infrastructure, networking devices, and other related end products. TrendForce has therefore narrowed its forecasted QoQ decline in consumer DRAM prices for 4Q20 from the previous range of 10-15% to the current 0-5%. As for mobile DRAM and server DRAM, although procurement activities for these product categories have risen to some degree, this increased procurement is inadequate to change their current oversupply situations.

On the other hand, in spite of the marginal recovery in the quantity of NAND Flash spot trading transactions because some countries have begun to ease the emergency measures for containing the spread of the COVID-19 pandemic, TrendForce maintains that the NAND Flash market as a whole will remain fairly weak over the long term. A price rally will unlikely happen in the near future, especially as the competition intensifies in the upstream part of the NAND Flash supply chain.