© Omdia

Analysis |

Semiconductor industry avoids direct impact of coronavirus

The semiconductor industry appears to have escaped the direct impact of the coronavirus crisis so far, but the market is likely to suffer the repercussions as the outbreak slows or suspends production among electronics manufacturers, according to Omdia.

Despite facing logistical, packaging and test challenges related to the coronavirus, semiconductor fabs located in China are continuing to function normally, with high capacity rates.

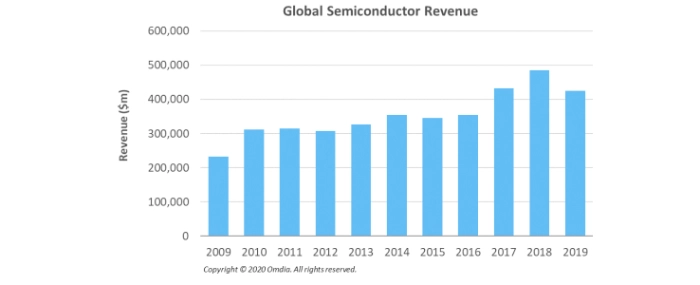

However, the risks are considerable, given the semiconductor market represents a huge component of the global economy, generating an estimated USD 424.8 billion in revenue in 2019 alone, as reported by the Omdia Semiconductor Competitive Landscaping Tool. A potential disruption to Chinese chip production could have major ramifications for worldwide economic growth.

“Global chip supply through the first two months of 2020 appears to be largely unaffected by the coronavirus outbreak,” said Len Jelinek, research vice president, components & devices, for Omdia. “There’s plenty of chip inventory in the channel, compensating for any coronavirus-related production shortfalls at semiconductor fabs located in the Wuhan area and elsewhere in China. Also, few semiconductor suppliers are located in areas affected by the virus, and all of the parts sold by these companies can easily be sourced from other chipmakers.”

The real danger for the semiconductor industry lies elsewhere, as the coronavirus disrupts production at electronic manufacturing companies that represent some of the world’s largest semiconductor purchasers.

“With electronic manufacturing services (EMS) and original design manufacturing (ODM) companies facing challenges regarding the number of workers returning from the Lunar New Year closings, the global market will face serious challenges as it enters the second quarter,” Jelinek said. “China is a major center for manufacturing services, with organizations including Foxconn basing massive factories in the country. These companies represent major purchasers of semiconductors, accounting for 29 percent of global purchasing this year.”

Major EMS/ODM operations in the region include Foxconn’s iPhone production operations located about 300 miles from Wuhan in Zhengzhou. This plant is open and running—but only at about 10 to 20 percent of capacity due to workforce issues. Other EMS/ODM operations in the area, including those run by Jabil and Wistron, are also suffering workplace issues, but these don’t have the major impact on the semiconductor demand that Foxconn does.

The capacity utilization rate for all electronics manufacturers in China presently is lower than normal. This is mainly due to labor shortages, with many workers still not returning to work. Furthermore, demand is seasonally weak, reducing stress on suppliers.

Coronavirus slows import/export activity

Although semiconductor supply appears to be intact, suppliers in China are encountering challenges related to the outbreak.

“For foreign semiconductor companies, especially fabless firms, the greatest challenge is import and export logistics,” said Hui He, principal semiconductor analyst for Omdia. “Because of the controls placed on flights in and out of China, many government staff members haven’t returned to work. As a result, the import/export process in China now is taking much longer than before, slowing the pace of commerce.”

However, the impact of this logistical slowdown is being mitigated by the fact that the first quarter is the slowest period of the year for the global electronics business. With production rates at relatively low levels, the negative impact of coronavirus has not been fully felt yet.

Fabs cleanliness prevents disease spread

Semiconductor fabs are inherently clean and highly automated, yielding an environment that’s not conducive to the spread of disease. As a result, foundries operating in the country—including SMIC, TSMC and UMC—have been able to maintain normal production conditions without any changes. Capacity utilization rates at these fabs remain high.

In Wuhan itself, semiconductor supplier YMTC has kept its production line running at normal levels. The XMC fab in the Wuhan area is running smoothly as well.

Package and test challenges

For chipmakers, the impact is more serious in the package and testing realm. Due to labor shortages, many package and testing plants in China have reduced or even stopped operations. This has created a bottleneck for chip companies that rely on such back-end package and testing capacity.

At present, many small and medium-sized chip design companies are faced with a dilemma of being unable to obtain sufficient production capacity from both fabs and package suppliers. If this production slowdown continues for an extended period, these design companies may face bankruptcy, or acquisition.

Other coronavirus developments

Most of the Chinese factories that are part of the supply chain for microelectromechanical systems (MEMS) and sensors declared that the operations would restart on February 10.

Sensor suppliers indicate that they have enough stock to cover for the suspension of production during the extended Lunar New Year holiday, which halted production until February 10.