© FBDi

Analysis |

Passives drive the German component distribution market

German component distribution market (according to FBDi e.V.) experienced solid growth in 2018. The order situation is slightly weakening. Slow return to normality for passive components.

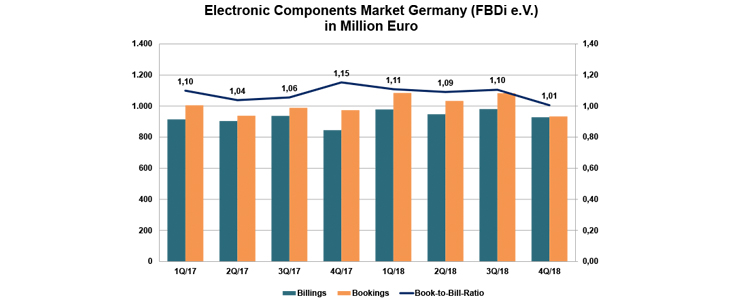

Unusually high sales growth of almost 10% in the last quarter of 2018 brought a conciliatory ending of the year for the German electronic component distribution market. Sales by distribution companies under the umbrella of the Fachverband Bauelemente-Distribution (FBDi e.V.) grew 9.8% to EUR 928 million. Conversely, orders fell 4.2% to EUR 933 million, equating to a balanced book-to-bill ratio of 1.01. The year 2018 overall resulted in sales of EUR 3.83 billion (up 6.5%).

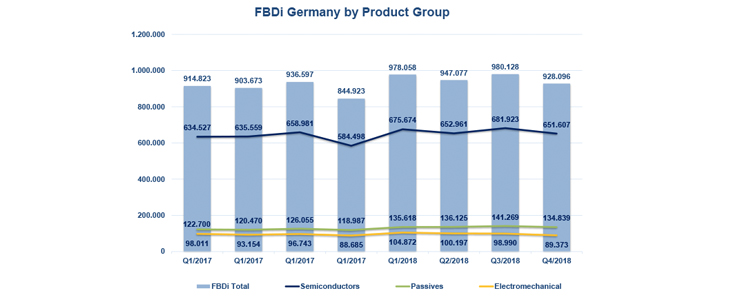

Among the major product segments, passive components achieved the strongest growth of 13.3% (to EUR 134 million), followed by semiconductors (11.5% to EUR 652 million) and electromechanics (0.8% to EUR 89 million). Power supplies grew 5% to reach EUR 25 million, while displays declined 13.4% to EUR 17.3 million. The distribution by component type showed a slight growth in semiconductors and passives – with semiconductors accounting for 70.2% and passives 14.5% – while electromechanics (9.6%) and power supplies (2.7%) fell slightly. Other products contributed 3% to the overall figure.

For the full year 2018, FBDi members achieved a positive outcome: Sales rose by 6.5% (to EUR 3.83 billion) and orders grew 5.8% (to EUR 4.13 billion). The current quarter will reveal how far the order buffer extends into 2019.

FBDi Chairman of the Board of Directors Georg Steinberger remarked: “Astonishingly, all quarters recorded nearly the identical sales levels with component shortages offsetting the usual seasonal variations. Given the decreasing order levels, however, this trend is unlikely to continue throughout 2019. Any growth is more likely to be in the low single-digit range.”

With regard to the general future outlook, Steinberger added: “For now, we must await the effects of Brexit and the dent in the German automotive industry, as well as several uncertainties outside Europe that will come our way over the next 12 to 18 months. The solution to the climate change challenge facing society lies in smarter and more efficient technologies and systems that can be expected to underpin lasting and increased demand for electronics. For this reason, the prospects for us high-tech service providers should remain good to excellent.”