© Reed Electronics Research

Analysis |

EMEA EMS industry set to exceed €35 billion by 2022

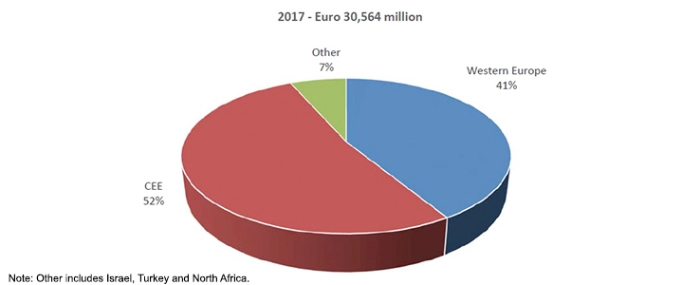

According to Reed Electronics Research’s latest analysis, revenues for the EMS industry in Europe, Middle East & Africa (EMEA) are forecast to reach Euro 35’616 million in 2022 up from Euro 30’564 million in 2017.

CEE still remains the largest region, due to the dominant position held by the leading global EMS providers and most notably Foxconn, which accounted for an estimated 40.4% of the Euro 15’948 million in EMS revenues generated in the region in 2017. Revenues from EMS manufacturing operations in Western Europe amounted to Euro 12’608 million in 2017, 41.3% of the European total, with the remainder from facilities in the Middle East and Africa.

With the rise of initiatives in Industry 4.0, more complex assembly of devices connected through the Internet of Things (IoT) and increases in vehicle electronics, the total value of Western European EMS revenues has begun to rise modestly and continues to grow. A decline in revenues in Italy and negative growth in euros in the UK, however impacted the EMS industry in the region during 2017. A marked fall in sales at two of the leading EMS providers in Germany also subdued growth in the region’s most important market.

Over the period to 2022, constant pressures on price and the transfer of production from Western European plants to manufacturing facilities in CEE/MENA will continue. EMS will also be under pressure from their global OEM customers to offer local manufacturing in other world regions and this will temper growth in some areas of Western Europe. In 2022, RER forecasts that EMS revenues generated in Western Europe will reach Euro 14’453 million with growth accelerating in the later part of the forecast.

In 2017, the Aerospace & Defence, Automotive, Medical, Control & Industrial and Telecoms (ADAMCIT) segments accounted for 70% of West European EMS revenues with the percentage forecast to increase to 72.2% in 2022. In the CEE and other low-cost countries, the focus remains on the Computer, Consumer and Communication (3C) sectors but with continuing and increasing transfer of production of low and medium volume/high mix electronic assembly from Western European EMS. In 2022, the ADAMCIT segments in the CEE are forecast to account for 17.0% of revenues and compared to 16.0% in 2017.

As we enter 2019 however, there are a number of potential headwinds which could subdue shortterm demand. Lower growth in the world economy, an escalation in the trade conflict between the US and China and the uncertainties surrounding Brexit could all dampen growth.

For more information on the analysis, visit Reed Electronics Research, or register for Evertiq Expo in Gothenburg (January 23, 2019) where Peter Brent from RER will go through the data as well as issues and trends. For more information and registration to the event follow this link.

For more information on the analysis, visit Reed Electronics Research, or register for Evertiq Expo in Gothenburg (January 23, 2019) where Peter Brent from RER will go through the data as well as issues and trends. For more information and registration to the event follow this link.