© New Venture Research

Analysis |

Contract manufacturing market recovers in 2017 after four years of decline

In its annual electronics manufacturing services report, New Venture Research (NVR), says that in 2017, the worldwide contract manufacturing (CM) services market increased significantly by 10.8 percent in total revenue, resulting in combined EMS and ODM revenue of USD 471 billion.

Over the last four years the CM market has been in decline but recovered substantially in 2017.

The CM market was sustained by the strong demand for smart phones, which resulted in an increase in assembly revenue of USD 14 billion in 2017. Capital spending in wireless infrastructure exceeded an additional USD 3 billion in orders in 2017 as carriers prepare for the next‐generation 5G networks. Enterprise LAN system assembly was very strong in 2017, as cloud computing requires distributed data centers worldwide.

For the eighth year in a row, the industry was profitable at USD 8.4 billion (for 41 EMS public companies and 18 ODM public companies). Foxconn accounted for nearly half of all the money made by the EMS industry in 2017, and EMS companies accounted for approximately 78 percent of the total. Only four EMS companies and two ODM companies lost money in 2017. Pegatron ranked second in net income (USD 527 million) for EMS companies, followed by Flex (USD 320 million), while Quanta Computer, Delta Electronics, and Qisda ranked highest in earnings for the ODMs.

Plant closures and openings were insignificant in 2017, as most companies appear to have right‐sized their operations or closed facilities resulting from completed acquisitions. The new openings are clearly related to new business opportunities, while the closures are being driven by economic performance requirements such as right‐sizing the company.

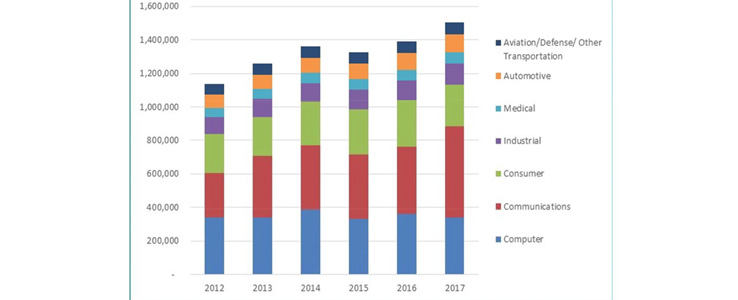

Figure 2 presents the total available market for electronics assembly from 2012 to 2017 by segment. The overall market demand for electronic products is projected to continue growing throughout the forecast period. NVR expects overall combined market growth to be at a CAGR of 7.5 percent over the next five years.

Communications and computer products will continue to be the segments driving the largest growth in the electronics industry. In 2022, the total industry is expected to reach USD 1.7 trillion in annual assembly value (COGS), as consumption and replacement of electronic products continue and new products stimulate demand. Outsourcing has become a critical element in keeping the electronics assembly industry expanding and driving costs down each year. The trend to move price‐sensitive manufacturing to low‐cost regions has subsided, but will continue to impact the industry for all suppliers in the foreseeable future.

For more information about The Worldwide Electronic Manufacturing Service Market – 2018 Edition, visit New Venture Research.

For more information about The Worldwide Electronic Manufacturing Service Market – 2018 Edition, visit New Venture Research.