© Trendforce

Analysis |

3Q/18 contract price hike for server DRAM limited due to improved supply

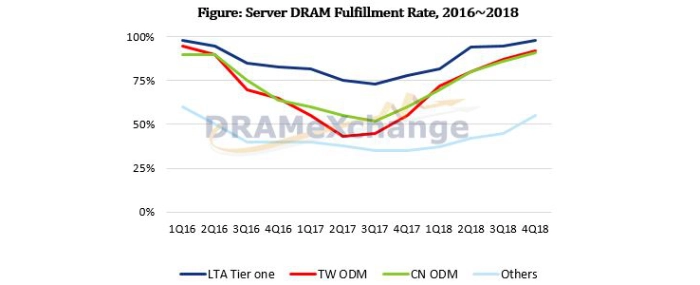

The shortfall in the supply of server DRAM may ease in the second half, as evidenced by the increasing average shipment fulfilment rate in the past several quarters, according to DRAMeXchange, a division of TrendForce.

This is a product release announcement by Trendforce. The issuer is solely responsible for its content.

As a result, following the 10 percent sequential hike in contract prices in the first half, the average shipment fulfilment rate has topped 80 percent now, thanks to the adjustment of output share of server DRAM by DRAM suppliers, which has helped to ease the tight supply situation, says Mark Liu, the senior analyst of DRAMeXchange.

DRAMeXchange points out that the prices of 32 GB server modules to be shipped to the first-tier firms in Q3 may advance by 1-2 percent to USD 320. Meanwhile, second-tier makers will become benefited thanks to increased shipment fulfilment rates. Consequently, the range of quotes for Q3 contract prices will be limited.

Meanwhile, affected by the increased penetration rates of Intel’s Purley and AMD’s Naples platform, the average density and penetration rate of 32 GB product lines will increase in the second half, sustaining the demands for server DRAM. The stocking-up demands for Intel's new solutions will remain robust, with shipment still mainly for data centres in North America and China. The penetration rate of Intel’s Purley platform is expected to approach 80 percent in Q4, up from over 50 percent now, while penetration rate of 32 GB server modules will exceed 70 percent by the end of the year, according to DRAMeXchange.

In terms of the development of process technology, 20nm will remain the mainstream process for DRAM this year and stocking-up demands for high-density server modules will continue to the end of the year, thanks to the effect of new platform solutions. Currently, the share of products featuring advanced process remaining low. In addition, die shrink technology will become increasingly complicated after the migration to 17nm and 18nm processes. Therefore, except Samsung which has applied 18 nm process in the mass production of server products, other DRAM suppliers will not begin increasing the share of products with advanced process until Q4, due to the consideration of product reliability.