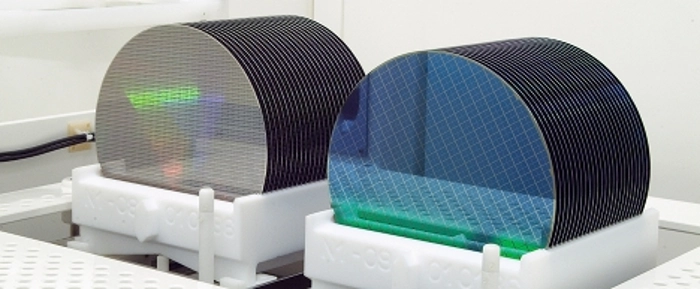

© infineon (illustration purpose only)

Analysis |

List: Texas and Infineon top Industrial chip ranking

Get real - Why Texas Instruments and Infineon Technologies prove IoT and AI are not winning strategies for Industrial Semiconductors.

Texas Instruments was the leading vendor of semiconductors to the industrial sector in 2016, ahead of Infineon Technologies. Intel, STMicroelectronics and Analog Devices completed the top five.

Semicast defines the industrial sector to include traditional areas such as factory automation, motor drives, lighting, building automation, test & measurement and power & energy, as well as medical electronics and industrial transportation; the aerospace & defense sector is excluded from the analysis. Using this definition, Semicast estimates that revenues for industrial semiconductors totaled USD 42.2 billion in 2016, a rise of about four percent from USD 40.7 billion in 2015.

In practice the industrial sector is a collection of markets within a market and is heavily fragmented across applications, OEMs and regions. Accordingly, it has no dominant semiconductor vendor, with the top ten together accounting for only around forty percent of the total in 2016. Colin Barnden, Principal Analyst at Semicast Research and study author commented “The vendor share ranking shows the importance of product expertise to ensure success in the industrial sector. For example, TI is the market leader for analog ICs; Infineon the leader for power devices; Intel for microprocessors; and Nichia for LEDs.”

Semicast sees TI, and Infineon and Nichia too, succeeding in the industrial sector not from a focus on IoT, but from a focus on what could be termed the real world. In comparison, IoT and other equally hyped trends such as AI, AR and VR, could be termed the machine world. These categories align neatly with specific functions, and therefore semiconductor product types, as follows:

*2016 Market Size: USD 42.2 billion

-----

More can be found at Semicast Research.

- Real World: functions of measure, move, sense and indicate, which correspond to the product categories of analog, optoelectronics, power & discretes and sensors.

- Machine World: functions of authenticate, control, process, store and communicate, which correspond to the product categories of logic, memory, microcontrollers & DSPs and microprocessors.

| 1 | Texas Instruments 7.9% |

| 2 | Infineon Technologies 6.6% |

| 3 | Intel 5.2% |

| 4 | STMicroelectronics 5.1% |

| 5 | Analog Devices 3.7% |

| 6 | NXP Semiconductors 3.5% |

| 7 | Nichia 2.8% |

| 8 | Micron Technology 2.3% |

| 9 | ON Semiconductor 2.0% |

| 10 | Renesas Electronics 1.8% |

| Top 10 Total 40.9% | |

| Others 59.1% |