© ic insights

Analysis |

U.S. companies hold largest share of fabless company IC sales

Research shows that fabless IC suppliers represented 30 percent of the world’s IC sales in 2016 (up from only 18 percent ten years earlier in 2006). As the name implies, fabless IC companies do not have an IC fabrication facility of their own.

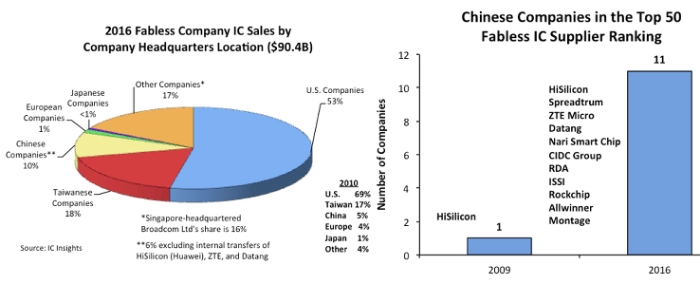

The 2016 fabless company share of IC sales by company headquarters location. At 53 percent, the U.S. companies held the dominant share of fabless IC sales last year, although this share was down from 69 percent in 2010 (due in part to the acquisition of U.S.-based Broadcom by Singapore-based Avago). Although Avago, now called Broadcom Limited after its merger with fabless IC supplier Broadcom became official on February 1, 2016, has fabrication facilities that produce III-V discrete devices, it does not possess its own IC fabrication facilities and is considered by IC Insights to be a fabless IC supplier.

In 2009, there was only one Chinese company in the top-50 fabless IC supplier ranking as compared to 11 in 2016. Moreover, since 2010, the largest fabless IC marketshare increase has come from the Chinese suppliers, which held a 10 percent share last year as compared to only 5 percent in 2010. However, when excluding the internal transfers of HiSilicon (over 90 percent of its sales go to its parent company Huawei), ZTE, and Datang, the Chinese share of the fabless market drops to about 6 percent.

European companies held only 1 percent of the fabless IC company marketshare in 2016 as compared to 4 percent in 2010. The reason for this loss of share was the acquisition of U.K.-based CSR, the second largest European fabless IC supplier, by U.S.-based Qualcomm in 1Q15 and the purchase of Germany-based Lantiq, the third largest European fabless IC supplier, by U.S.-based Intel in 2Q15. These acquisitions left U.K.-based Dialog (USD 1.2 billion in sales in 2016) as the only Europe-headquartered fabless IC supplier in the fabless top 50-company ranking last year (Norway-based Nordic Semiconductor just missed making the top 50 ranking with 2016 sales of USD 198 million).

There is also only one major fabless Japanese firm—Megachips, which saw its sales increase by 20 percent in 2016 (8 percent using a constant 2015 exchange rate), one major South Korean fabless IC company (Silicon Works), and one major Singapore-based (Broadcom Ltd.) fabless supplier.

-----

More information can be found on IC Insights website.