Global silicon wafer shipments rise in 2025, revenue declines

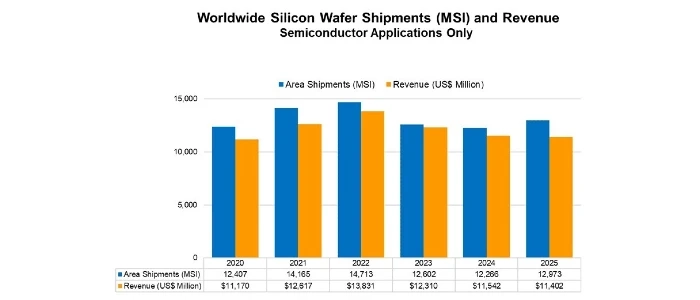

Global silicon wafer shipments increased in 2025, while total wafer revenue declined slightly, according to year-end data from SEMI.

Total wafer shipments rose 5.8% year-on-year to 12,973 million square inches (MSI). Over the same period, wafer revenue fell 1.2% to USD 11.4 billion, SEMI’s Silicon Manufacturers Group (SMG) reported.

SEMI says 2025 marked a return to growth in wafer shipments, supported by strong demand for advanced epitaxial wafers in logic and polished wafers for high-bandwidth memory (HBM), driven by AI applications.

At the same time, revenue growth was constrained by weaker demand and pricing in traditional semiconductor segments. SEMI attributed the softer revenue performance to continued slow recovery in mature-node applications, where market conditions have yet to fully normalise.

Demand for 300 mm wafers remained strong in advanced applications, particularly in AI-driven logic and HBM, supported by the adoption of sub-3 nm process technologies.

In contrast, the legacy semiconductor segment showed early signs of stabilisation. Inventory levels in mature-node markets such as automotive, industrial and consumer electronics have begun to normalise following prolonged inventory adjustments.

"While supply-demand conditions are improving sequentially, the pace of recovery remains moderate, with demand recovery still sensitive to macroeconomic factors and end-market dynamics. As a result, the overall market outlook reflects a two-track trajectory: sustained demand and technical advancement in advanced nodes, alongside a cautious and incremental rebound for demand in mature technology segments," said Ginji Yada, Chairman of SEMI SMG and Executive Office Deputy General Manager, Sales and Marketing Division at SUMCO Corporation, in a press release