Global smartphone shipments rise 4% in Q4 2025, led by Apple

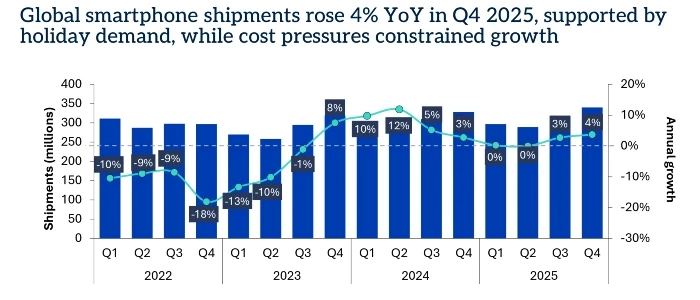

Global smartphone shipments increased 4% YoY in the fourth quarter of 2025, supported by seasonal demand and tighter inventory management, according to new data from market research firm Omdia. Growth was concentrated among the largest vendors, while rising component costs began to weigh on parts of the market.

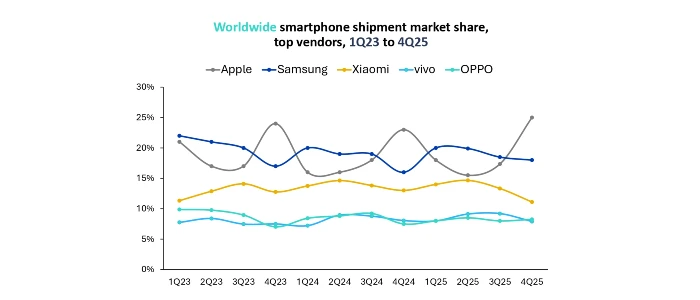

Apple led the global smartphone market in Q4 2025 with a 25% share, delivering what Omdia described as a record fourth quarter. Demand for the iPhone 17 series was the main driver, and Apple also finished 2025 as the world’s largest smartphone vendor for the third consecutive year, marginally ahead of Samsung.

Samsung ranked second in the quarter with an 18% market share. Its performance was driven primarily by demand in the sub-USD 300 segment, particularly for the Galaxy A17 4G and 5G models. Xiaomi held on to third place both for the quarter and for the full year, although its Q4 market share declined to 11% amid volume challenges in some key markets.

vivo captured 8% of global shipments in Q4, supported largely by its strong position in India. OPPO re-entered the global top five during the quarter as it returned to growth, ahead of its planned integration of realme into its business from January 2026.

| Vendor | 4Q25 market share | 4Q24 market share |

| Apple | 25% | 23% |

| Samsung | 18% | 16% |

| Xiaomi | 11% | 13% |

| vivo | 8% | 8% |

| OPPO | 8% | 7% |

| Others | 30% | 32% |

For the full year 2025, global smartphone shipments rose 2% year on year to 1.25 billion units. According to Omdia, the year was marked by an uneven recovery, with a weaker first half followed by stronger demand in the second half, driven by emerging markets and positive reception of new flagship devices.

Omdia noted that rising memory costs and component shortages began to constrain shipment volumes toward the end of the year. In particular, the tight supply of DRAM has added pressure across the industry, affecting both LPDDR4 and LPDDR5 availability.

Looking ahead, Omdia expects rising semiconductor costs and a slowing refresh cycle to weigh on shipment momentum in 2026.