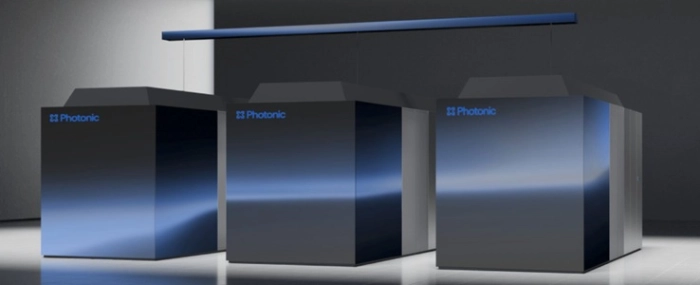

Photonic raises $130M to advance quantum computing

The Canadian company is accelerating the path to fault‑tolerant quantum systems with their Entanglement First Architecture that combines silicon‑based qubits and native photonic connectivity, enabling seamless scaling across existing global telecom infrastructure.

Canadian quantum computing company Photonic has announced that it has raised USD 130 million in the first close of its latest investment round, led by Planet First Partners, with participation from new investors Royal Bank of Canada (RBC), TELUS, and others.

Existing investors, including BCI and Microsoft, also returned for this round, bringing the total raised by the company to USD 271 million, Photonic said in a press release.

Photonic is accelerating the path to fault‑tolerant quantum systems with their Entanglement First Architecture that combines silicon‑based qubits and native photonic connectivity, enabling seamless scaling across existing global telecom infrastructure. With this new funding, it will continue advancing key product milestones toward commercialization, expanding its technical and business teams, and deepening customer and partner engagements, the company said.

“Photonic’s distributed architecture provides a credible path to rapidly scale towards utility-scale systems — enabling innovations in areas such as battery materials, low-carbon catalysts, and drug design that can meaningfully accelerate climate solutions and improve global wellbeing,” said Nathan Medlock, Managing Partner at Planet First Partners.

Headquartered in Vancouver, British Columbia, Photonic also has operations in the US and the UK.

“Photonic’s game‑changing approach to deliver on the decades‑old promises of quantum computing continues to be fueled by committed investors and best‑in‑class employees,” said Paul Terry, CEO of Photonic. “This funding round attracted not only new financial investors but also partners from sectors poised to be transformed by quantum technology — including sustainability, telecommunications, finance, and security.”

“We believe Photonic’s scalable quantum architecture has the potential to unlock key applications in the financial sector, ranging from security through to portfolio optimization and risk modelling,” said Barrie Laver, Managing Director, Head of Venture Capital & Private Equity with Royal Bank of Canada.

“Photonic’s approach to distributed quantum computing and networking is exactly the kind of game-changing innovation we seek,” said Terry Doyle, Managing Partner at TELUS Global Ventures. “Together, we’re not just investing in technology, we’re building Canada’s quantum future and delivering solutions that will transform industries worldwide.”

“As one of Photonic’s largest shareholders, BCI is proud to support the Photonic team in the pursuit of developing one of the world’s first fault-tolerant quantum computers,” said Gordon J. Fyfe, Chief Executive Officer and Chief Investment Officer at BCI.