Global 300mm fab equipment spending to reach $374B by 2028

Global spending on 300mm semiconductor fabrication equipment is projected to reach USD 374 billion from 2026 and 2028, driven by rising demand for AI chips and efforts to strengthen regional semiconductor self-sufficiency, according to SEMI’s latest 300mm Fab Outlook.

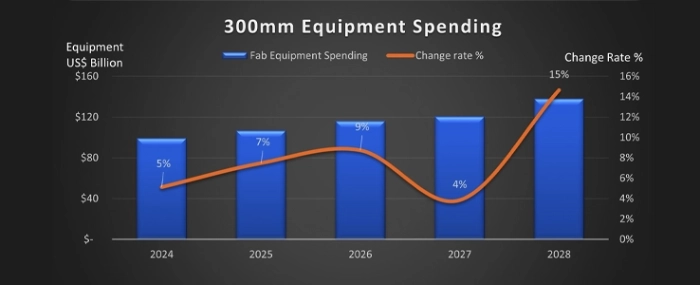

Worldwide 300mm equipment investment is expected to surpass USD 100 billion for the first time in 2025, reaching USD 107 billion, and grow further to USD 116 billion in 2026, USD 120 billion in 2027, and USD 138 billion in 2028.

"The semiconductor industry is entering a pivotal era of transformation, driven by unprecedented demand for AI-enabled technologies and a renewed focus on regional self-sufficiency," said Ajit Manocha, President and CEO of SEMI, in a press release. "Strategic global investments and collaboration are driving robust, advanced supply chains and faster deployment of next-generation semiconductor manufacturing technologies. The global expansion of 300mm fabs will enable progress in data centers, edge devices, and the digital economy."

Segment-specific growth

The Logic & Micro segment is expected to lead equipment expansion, with USD 175 billion in investment from 2026 to 2028. Growth will be largely driven by foundries building sub-2nm capacity, supported by advanced technologies including gate-all-around (GAA) architecture and backside power delivery. Production of 1.4nm process technology is projected to begin volume manufacturing by 2028-2029. Rising AI workloads are also expected to boost demand for edge devices, including automotive electronics, IoT applications, and robotics.

Memory-related investment is projected at USD 136 billion over the same period, marking a new growth cycle for the segment. DRAM equipment investment is expected to exceed USD 79 billion, while 3D NAND spending will reach USD 56 billion. High-bandwidth memory and storage capacity demand are being fueled by AI training and inference, which require faster data transmission and greater storage for high-quality digital content.

Analog and compound semiconductor segments are expected to account for USD 41 billion and USD 27 billion in investments, respectively, between 2026 and 2028.

Regional investment trends

China is forecast to remain the largest 300mm equipment spender, investing USD 94 billion over the next three years, supported by national self-sufficiency policies. Korea follows with USD 86 billion, primarily to meet global generative AI demand, while Taiwan is projected to invest USD 75 billion, focusing on 2nm and sub-2nm capacity to maintain advanced foundry leadership.

The Americas are expected to invest USD 60 billion, with U.S. suppliers expanding advanced process capacity to meet AI application demand and support domestic industrial upgrades. Japan, Europe & the Middle East, and Southeast Asia are projected to invest USD 32 billion, USD 14 billion, and USD 12 billion, respectively. Policy incentives in these regions are expected to raise equipment investment by more than 60% by 2028 compared with 2024.