Global robot demand in factories doubles over a decade

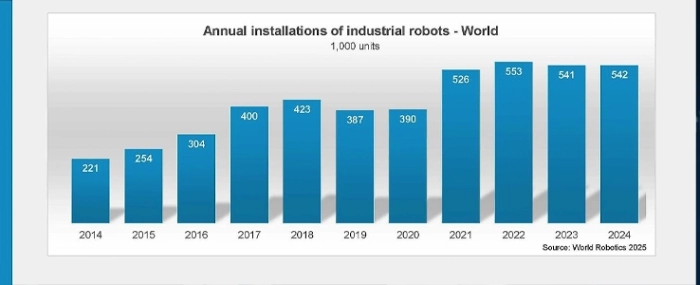

Global demand for industrial robots has more than doubled in the past ten years, according to the International Federation of Robotics (IFR). The latest World Robotics 2025 report shows that 542,000 new robots were installed in factories during 2024, marking the fourth consecutive year with installations above 500,000 units.

Asia accounted for the majority of deployments, representing 74% of new installations, compared with 16% in Europe and 9% in the Americas.

“The new World Robotics statistics show 2024 was the second-highest annual installation count of industrial robots in history - only 2% lower than the all-time high two years ago,” said IFR President Takayuki Ito. “The transition of many industries into the digital and automated age has been marked by a huge surge in demand. The total number of industrial robots in operational use worldwide was 4,664,000 units in 2024 – an increase of 9% compared to the previous year.”

Asia leads the global market

China remained the largest market, with 295,000 installations in 2024, representing 54% of the global deployments. For the first time, domestic manufacturers sold more units than foreign suppliers in China, reaching a 57% market share. The country’s operational stock exceeded two million robots. IFR projects annual growth of around 10% in the Chinese market through 2028.

Japan, the second-largest market, saw 44,500 installations in 2024, a 4% decline from the previous year. The Republic of Korea ranked fourth worldwide with 30,600 units, down 3%. India continued its upward trajectory with a record 9,100 installations, up 7% year-on-year, led by demand from the automotive sector.

Europe records decline

In Europe, industrial robot installations fell 8% to 85,000 units, though this was still the second-highest figure on record. Germany accounted for nearly a third of the European total with 26,982 installations, down 5% from 2023. Italy recorded 8,783 units, a 16% decrease, while Spain and France followed with 5,100 and 4,900 units, respectively. In the UK, installations dropped 35% to 2,500 units, reflecting the end of the temporary “super-deduction” tax incentive in 2023.

Americas weaken

Installations in the Americas totalled 50,100 units in 2024, a 10% decline. The United States led with 34,200 installations, down 9% from the previous year. Mexico and Canada followed with 5,600 and 3,800 units, respectively, both registering declines linked largely to fluctuations in automotive investment.

Outlook remains positive

Despite weaker results in several regions, IFR forecasts a resumption of growth in 2025. Global robot installations are expected to rise 6% to 575,000 units in 2025, surpassing 700,000 by 2028. While geopolitical tensions and economic uncertainty remain risks, IFR said long-term demand for automation in manufacturing remains strong.