© IC Insights

Components |

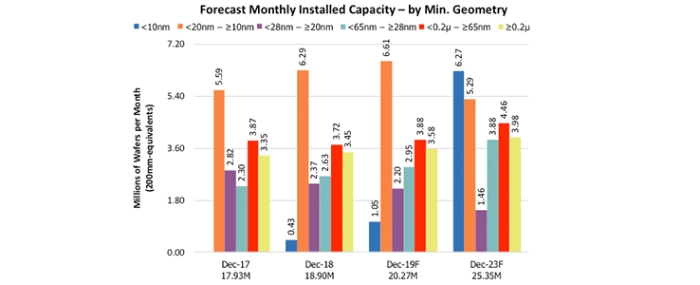

Wafer capacity by feature size shows rapid growth at <10nm

Leading-edge processes (<28nm) took over as the largest portion in terms of monthly installed capacity available in 2015. By the end of 2019, <28nm capacity is forecast to represent about 49 percent of the IC industry’s total capacity.

At the very leading edge, <10nm processes are now in volume production and are forecast to represent 5 percent of worldwide capacity in 2019. The share of <10nm capacity is forecast to jump to 25 percent and become the largest capacity segment by 2023.

South Korea (Samsung) and Taiwan (TSMC) are currently the only two regions with fabs processing what are being called <10nm processes. South Korea and Japan both have large shares of capacity in the <20nm – ≥10nm segment, with the vast majority of it being used to produce NAND flash (equivalent feature size) and DRAM, but also some for advanced logic and application processors built with 14nm, 10nm, or 8/7nm technology. Taiwan also has a large share of the <20nm – ≥10nm capacity, with roughly half of it being for foundry services and the other half for DRAM production.

Trends at the leading edge have been changing and the industry is departing from historical 'norms'. The grey area of what constitutes a generation and how to measure the minimum process geometry gets more difficult every year. Therefore, any assumptions made regarding the wafer fab capacity of new process technologies can have a big impact on the forecast for wafer capacity by minimum feature size.

Other findings from the Global Wafer Capacity 2019-2023 report include,

- South Korea remains significantly more leading-edge (i.e., <28nm) focused than the other regions or countries. Given Samsung and SK Hynix’s emphasis on high-density DRAM and flash memory products, it is not a surprise that the country has the highest concentration of wafer capacity dedicated to the leading-edge processes

- When only the most advanced processes (<20nm) are considered, South Korea also has the largest share of its total capacity dedicated to these processes than any other region. For logic-based processes, Taiwan, North America, and South Korea have the highest concentrations at the leading edge.

- Current leading-edge (<28nm) capacity in China is completely owned and controlled by foreign companies, namely Samsung, SK Hynix, Intel, and TSMC.

- Taiwan has the largest shares of capacity in the <65nm – ≥28nm and <0.2µ – ≥65nm technology segments. Nevertheless, the 28nm, 45/40nm, and 65nm generations continue to generate significant business volumes for foundries like TSMC and UMC