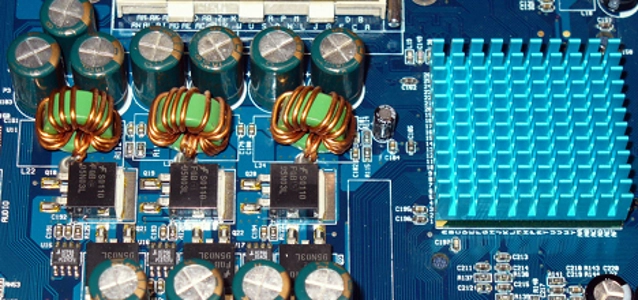

© ermess dreamstime.com

Business |

Fairchild up on sales

Fairchild Semiconductor reported second quarter sales of $371.6 million, up 8 percent from the prior quarter and 4 percent higher than the second quarter of 2013.

Fairchild reported second quarter net income of $17.8 million or $0.14 per diluted share compared to a net loss of $9.3 million or $0.07 per diluted share in the prior quarter and a net loss of $7.5 million or $0.06 per diluted share in the second quarter of 2013. Gross margin was 33.4 percent compared to 30.3 percent in the prior quarter and 29.1 percent in the year-ago quarter.

Fairchild reported second quarter adjusted gross margin of 33.4 percent, up 310 basis points from the prior quarter and 360 basis points higher than the second quarter of 2013. Gross margin in quarters prior to the second quarter of 2014 excluded accelerated depreciation related to a line closure. Adjusted net income was $25.2 million or $0.20 per diluted share, compared to adjusted net income of $4.9 million or $0.04 per diluted share in the prior quarter and $1.7 million or $0.01 per diluted share in the second quarter of 2013. See the Reconciliation of Net Income to Adjusted Net Income exhibit included in this press release for more details on the other adjustment items.

"Fairchild continues to deliver steady sales growth due to improved execution and broad-based demand strength," said Mark Thompson, Fairchild's chairman and CEO. "Our distribution sell-through or POS has grown for six consecutive quarters while our weeks of inventory in the channel decreased again to about 9 weeks. We are managing the supply chain very well to maintain short lead times and lean, yet responsive inventory levels to better support our customers. Our current backlog is modestly higher than a quarter ago and we expect to grow sales again in the third quarter. We generated strong cash flow in the second quarter due to improved earnings coupled with low capital spending and favorable changes in working capital. We repurchased 4 percent of our outstanding shares of stock during the second quarter and we plan to continue returning cash to shareholders.

Second Quarter Financials

"Adjusted gross margin increased 3 points sequentially due to better manufacturing execution in the second quarter and improved product mix," said Mark Frey, Fairchild's executive vice president and CFO. "R&D and SG&A expenses were $98.0 million, up 2 percent sequentially due to the annual merit increase and equity vesting offset by some one-time benefit cost reductions. Free cash flow was a positive $70 million for the second quarter. We ended the second quarter with total cash and securities exceeding our debt by $120 million which was up slightly from the prior quarter despite repurchasing $69 million in stock. This was due to higher net income, lower capital spending and favorable changes in working capital.