Global semiconductor supply chain remains concentrated, exposing bottlenecks

A new analysis of the global semiconductor supply chain highlights how critical stages of chip production remain concentrated among a handful of economies, underscoring the industry’s vulnerability to geopolitical and supply disruptions.

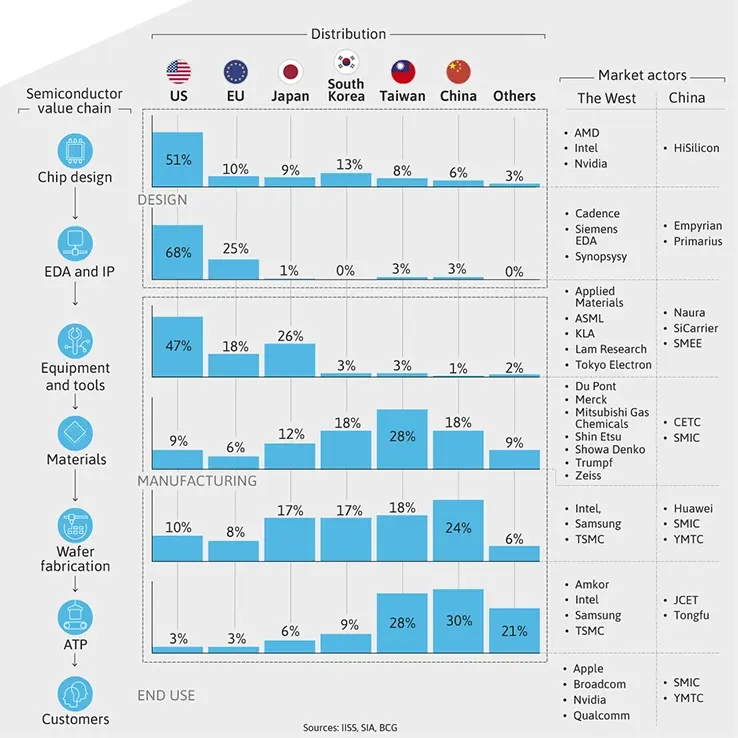

According to a briefing from GSIS (Global Security & Innovation Summit) – citing data from the International Institute for Strategic Studies (IISS), the Semiconductor Industry Association (SIA), and Boston Consulting Group (BCG) – the United States dominates the design and intellectual property layers of the semiconductor value chain, while East Asian economies lead in manufacturing, materials, and packaging.

The United States accounts for 51% of global chip design and 68% of electronic design automation (EDA) and IP. The country also leads in semiconductor manufacturing equipment, with a 47% global share, but holds just 10% of wafer fabrication and 3% of assembly, testing, and packaging (ATP) capacity, underlining dependence on Asian partners for advanced production.

The EU holds 10% of chip design, 25% of EDA/IP, 18% of equipment and tools, 8% of wafer fabrication, and 3% of ATP, maintaining a supporting role in high-end tooling and automotive-grade semiconductors.

Japan remains strong in the upstream supply chain, holding 26% of equipment and tools and 12% of materials, but its share of wafer fabrication stands at 17%. South Korea combines 17% of wafer fabrication and 18% of materials, reflecting its role as a major semiconductor manufacturing hub.

Taiwan represents a cornerstone of global manufacturing, with 18% of wafer fabrication and 28% of materials, alongside 28% of ATP, making it indispensable to advanced packaging and end-stage integration. China, meanwhile, holds 24% of wafer fabrication and leads in ATP with 30%, reflecting its expanding role in assembly and test operations, though it remains limited in chip design at 6% and EDA/IP at just 3%.

Together, these six economies – the US, EU, Japan, South Korea, Taiwan, and China – account for the vast majority of semiconductor value creation.

The data illustrate how semiconductor chokepoints – especially in advanced manufacturing and packaging – remain geographically concentrated in East Asia. Analysts warn that disruptions in any of these regions could have cascading effects across industries reliant on microchips, from consumer electronics to defence systems.

According to the briefing, the semiconductor supply chain involves over 50 countries across specialised stages, making full national reshoring virtually unfeasible without massive investment and years, many years, of coordination. On average, a single chip will directly involve 25 countries in the supply chain.

The GSIS briefing highlights the high degree of geographic concentration across the semiconductor value chain and notes that key production stages are clustered in a small number of economies. The document frames this concentration as a strategic challenge for governments seeking to reduce supply-chain vulnerabilities amid rising geopolitical tensions.

The fact that the semiconductor supply chain remains both fragmented and concentrated is hardly new, and it is likely to persist for the foreseeable future. Still, the data highlight clear regional strengths and bottlenecks, underscoring how geopolitical tensions, policy shifts, or industrial disruptions shake up the global semiconductor industry.