MBK to acquire majority stake in FICT for $656 million

Private equity firm MBK will hold an 80% stake in the Japanese PCB maker while California-based FormFactor will own 20% stake along with a seat on FICT’s board of directors.

Private equity firm MBK Partners is acquiring a controlling stake in Japan’s FICT, a PCB and substrate-producing company, for USD 656 million.

FormFactor, a California-based chip qualification and production test company, announced that it will acquire FICT together with MBK from Advantage Partners.

MBK will hold an 80% stake in the Japanese firm while FormFactor will own 20% stake along with a seat on FICT’s board of directors.

MBK said its investment decision was based on the rising demand for high-performing semiconductor components amid accelerating growth in the cloud computing and AI sectors.

“This acquisition aims to meet the increasing demand from global semiconductor companies driven by the rapid development of cloud computing and artificial intelligence (AI),” MBK Partners said. “Through collaboration with FormFactor, we will accelerate the development of innovative solutions in the semiconductor testing and packaging fields.”

The US company will invest about USD 60 million in the MBK-led consortium. The deal is expected to close in the first quarter of this year.

“The semiconductor industry’s rapidly accelerating adoption of advanced packaging requires increased investment and stronger collaboration across the test and assembly supply chain,” said FormFactor’s CEO Mike Slessor. “We’ve built a partnership with MBK, North Asia’s leading private equity firm, with a shared vision to enhance FICT’s long-term value by fully serving all FICT’s existing and potential customers.”

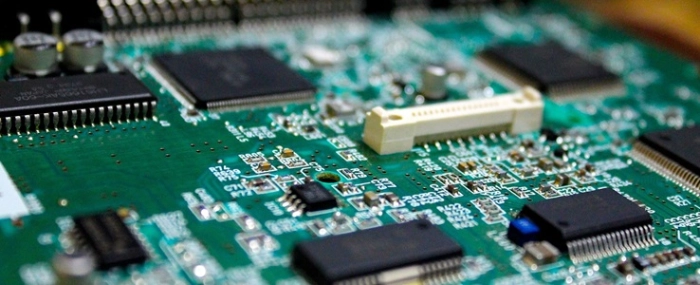

FICT manufactures high-performance PCBs and substrates for semiconductor test equipment and ICT infrastructure.