More pain to come for NAND Flash manufacturers?

Industry continues belt-tightening in bid to balance market in 2025

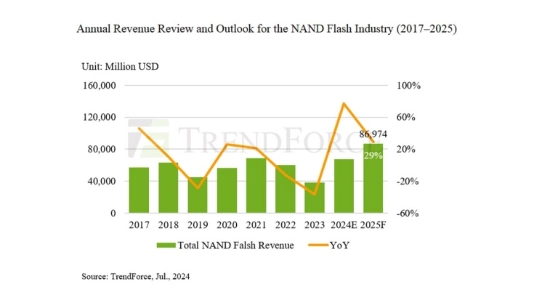

The NAND Flash industry will face continued pressure from weak demand and oversupply in 2025, according to the latest TrendForce research report. In response, manufacturers such as Micron, Kioxia/SanDisk, Samsung, and SK hynix/Solidigm are planning to cut back on production, with these measures aiming to address market imbalances and eventually to lead to long-term industry consolidation.

Manufacturers are primarily reducing production by lowering utilization rates and delaying process upgrades. This strategy is driven by three factors: sluggish shipments of consumer electronics like smartphones and notebooks, slowing corporate IT investments affecting enterprise SSD demand, and a downturn in NAND Flash prices since Q3, 2024.

Aggressive expansion by Chinese suppliers, fueled by domestic substitution policies, has added a further dimension to the challenges and intensified global market competition, with Micron, Kioxia/SanDisk, Samsung and SK hynix/Solidigm all announcing plans to reduce output. Companies that are heavily reliant on NAND Flash are expected to be particularly negatively impacted.

While manufacturers’ short-term production cuts may help stabilize prices and reduce oversupply, rising prices could increase costs for downstream producers, potentially hitting consumer demand. In the long term, production reductions may accelerate industry consolidation, posing risks for the less competitive players.

Manufacturers, suggest TrendForce, would be well-advised to focus on technological innovation and product differentiation to maintain viability and improve their competitive edge in time.

.jpg)