Automotive sensor market set to hit $14.3B by 2029

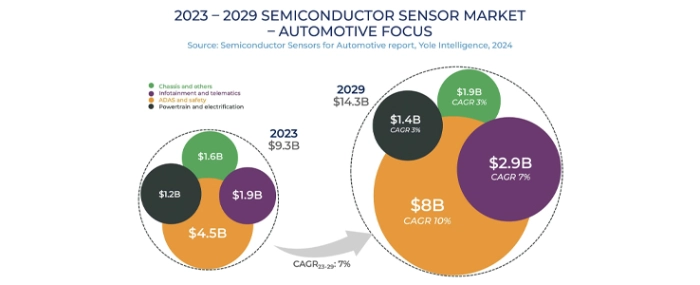

The global automotive sensor market is on track to grow from USD 9.3 billion in 2023 to USD 14.3 billion by 2029, driven by trends such as electrification and advanced driver-assistance systems (ADAS), according to a report by Yole Group.

This growth represents a compound annual growth rate (CAGR) of 7% over the forecast period. The strongest growth is expected in the LiDAR segment, which is projected to grow by 48% to USD 649 million by 2029. According to the analyst firm, radar and CMOS image sensors (CIS) will dominate the market, generating over USD 4 billion and USD 3 billion, respectively, in 2029.

Globally, 6.5 billion automotive sensors were shipped in 2023, and shipments are expected to approach 9 billion by 2029. During these coming years, the automotive industry is expected to go through massive transformations in all four car domains.

Powertrain and Electrification: With the transition from internal combustion engines to electrified vehicles, the electrification segment is projected to grow at a modest 3% CAGR. Electrified cars are expected to account for 43% of vehicle production by 2029, creating new opportunities for sensors while phasing out others.

ADAS and Safety: The ADAS segment, which supports autonomous and safer driving, is poised to generate USD 8 billion in revenue by 2029, making it the largest revenue contributor among all segments.

Infotainment and Telematics: With increasing demand for in-car entertainment and connectivity, this segment is expected to grow at a 7% CAGR, reaching USD 2.9 billion by 2029.

Chassis: automakers focus on enhancing passenger safety, supplying data to ADAS systems, and replacing hydraulic systems. This push for more sensors is driving a 3% annual growth in sensor volumes from 2023 to 2029, with revenues projected to reach USD 1.9 billion by 2029.

“The upcoming years are poised to witness a dynamic transformation in automotive sensor technology driven by advancements in ADAS, autonomous driving, electrification, and the widespread adoption of sensors across global car fleets. Consequently, substantial reorganization within the industry and its supply chain is anticipated. Therefore, there is a pressing need to develop strategic business plans and collaborate with suitable partners to capitalize on emerging opportunities,” says Pierrick Boulay, Senior Technology & Market Analyst at Yole Group, in a press release.

Evertiq has invited Pierrick Boulay to speak at its Expo in Sophia Antipolis on February 06, 2025, about how semiconductors are shaping the future of automotive.

Although growth in the global automotive market has been slow, the mid-term outlook for semiconductor devices remains promising. The number of semiconductor devices per vehicle is expected to rise significantly, from around 834 in 2023 to 1,106 by 2029. This growth is largely driven by the expanding adoption of Advanced Driver Assistance Systems (ADAS) and vehicle electrification. While semiconductor supply has improved compared to recent years, it continues to be a critical concern, with OEM strategies varying across industries and regions.

To address the limitations of traditional distributed systems, automakers are shifting towards centralising functions into fewer, more powerful Electronic Control Units (ECUs). This approach simplifies wiring and boosts performance but also introduces new challenges in managing increasingly complex systems.