Electrification and autonomy to boost semiconductor content in cars

Yole Group projects a transformative future for the automotive semiconductor market, fueled by advancements in electrification, ADAS, and computing power.

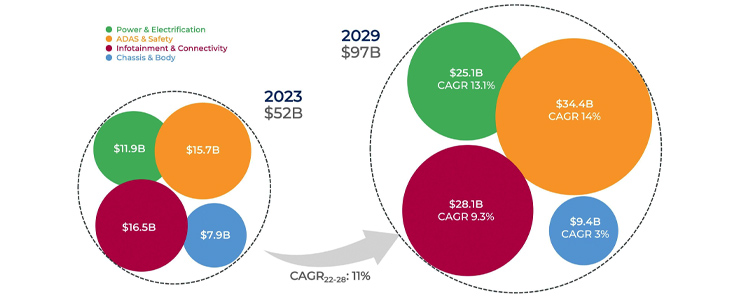

The automotive semiconductor market is set to reach nearly USD 100 billion by 2029, representing a compound annual growth rate (CAGR) of 11% from 2023 to 2029, according to Yole Group's newly released Semiconductor Trends in Automotive 2024 report. This growth underscores the sector's pivotal role in enabling next-generation vehicles, with semiconductor device value per car expected to climb from approximately USD 590 in 2023 to USD 1,000 by 2029.

ADAS (Advanced Driver Assistance Systems) and safety features are leading this surge, projected to grow at a 14% CAGR. Electrification follows closely, with over 13% CAGR during the same period. Despite slowing electrification adoption in Europe, the Chinese market is still very active – sustaining global momentum.

“The global automotive market is growing slowly, leaving some OEMs and suppliers in more challenging situations during the transformation. However, the mid-term picture still brings a significant 11% growth to the semiconductor device market, which will reach almost USD 100 billion in 2029,” stated Yole Group's Principal Analyst for Automotive Semiconductor in a press release.

In 2020, consulting firm Deloitte stated in a report that electronics make up 40% of a car's total cost, compared to 18% just over 20 years ago – a share that is expected to grow with the ongoing electrification.

The shift in OEM strategies

Yole’s report reveals a notable shift as automotive OEMs (Original Equipment Manufacturers) increasingly engaging upstream in the semiconductor supply chain. Power modules, which are critical enablers for EVs, serve as a prime example. As Yole points out, Nearly all Chinese OEMs have investments in this segment across various formats. Additionally, high-performance processors and MCUs are also highly favoured by OEMs.

Yole Group's report highlights several pivotal trends driving the semiconductor market forward.

For example, power Electronics. Demand for SiC MOSFET modules, crucial for efficient power conversion, is being driven by the increasing appeal of EVs. Advanced 16nm and 10nm MCUs becoming indispensable for ADAS applications, supporting radars, sensors, and the shift toward domain and zone controllers. As vehicles approach higher degrees of autonomy, pushing beyond level 3, the demand for robust computing and memory capabilities grows.

“The market currently represents a semiconductor device value of around USD 590 per car in 2023. With this figure growing to about USD 1,000 per car, semiconductor technology and its latest innovations become essential. At Yole Group, we highlight the significant trends linked to ADAS and electrification,” noted Pierrick Boulay, Senior Technology & Market Analyst at Yole Group.

Evertiq has invited Pierrick Boulay to speak at its Expo in Sophia Antipolis on February 06, 2025, about how semiconductors are shaping the future of automotive.

Despite slow growth in the global automotive market, the mid-term outlook remains positive for semiconductor devices, projecting a significant increase from approximately 834 devices per car in 2023 to 1,106 by 2029. As stated earlier, this growth is primarily fuelled by the increasing implementation of ADAS and vehicle electrification. Although semiconductor supply has improved compared to recent years, it remains a major concern, with OEM’s strategies varying across different industry segments and regions.

Consequently, to overcome the limitations of traditionally distributed systems, automakers have begun centralizing functions into fewer, more powerful Electronic Control Units (ECUs). While this centralisation simplifies wiring and enhances performance, it introduces new challenges in managing these more complex systems.