Another tough quarter for the German component distribution market

The consolidation of sales in the German component distribution market continues. The third quarter of 2024 also fell short of expectations.

"2024 is no cause for joy. Although the downturn was expected after years of explosive growth and despite the fact that customer inventories are being depleted slowly, there are hardly any positive signals from the market. It remains difficult to assess the situation of end customers, and the news from the industrial and automotive markets make it difficult to provide a stable forecast. Either way, 2025 is going to be exciting,” says FBDi Chairman Georg Steinberger in a press release

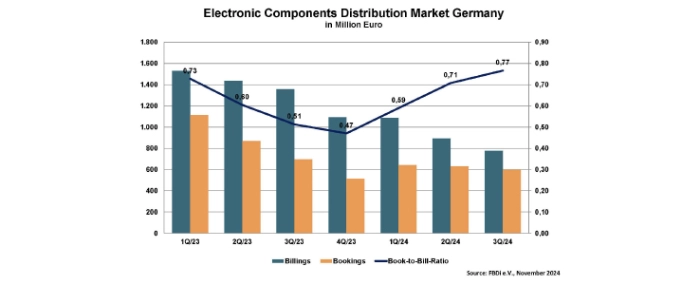

With a drop of almost 43%, the turnover of the FBDi reporting members decreased to EUR 779 million, the lowest level since the end of 2020. Bookings also remained moderate, reinforcing the view that a turnaround is still some way off. The book-to-bill ratio rose slightly to 0.77.

Again, semiconductors were hit hardest. Once the winners in the recent shortage, they are now suffering the most from sub-optimal market conditions. Compared to the third quarter of 2023, sales fell by 50% to EUR 477 million, while new orders remained at a low level of EUR 320 million (-13.5%). The book-to-bill ratio improved slightly to 0.67.

The situation for other components was less dramatic. Sales of passive components fell by "only" 32% to EUR 113 million. As the decline in incoming orders was less pronounced, the book-to-bill ratio improved to 0.83.

Sales of electromechanical components fell by 19% to EUR 124 million, order income by almost 9% to EUR 118 million and the book-to-bill ratio was just under 1.

In other product areas, the downturn is losing its steam, with single-digit declines and book-to-bill ratios of around 1. The sharp decline in semiconductors reduced their share of the total market to just a little over 61%.

“The distortions caused by the deteriorating geopolitical situation in recent years can be seen very clearly in the German market. Component distributors are heavily dependent on the success of customers in leading industry segments. They, however, are currently struggling with worsening economic conditions, a lack of innovation and a toxic political culture in which a necessary consensus for the future, as outlined by former Italian Prime Minister Mario Draghi, seems difficult to achieve. Unfortunately, this is not only the case in Germany, but as the largest economy in Europe, Germany is in danger of losing its role as a driving force for other regions,” continues Georg Steinberger.

Georg Steinberger and the FBDi are cautious about the prospects for 2025, saying that the market has yet to see a turnaround in incoming orders, so a return to growth before mid-2025 is rather unlikely.

"What is needed is the right impetus from the most important application markets in the direction of future-proof innovations. As ZVEI President Dr Gunter Kegel repeatedly emphasises, striving for an all-electric society is a matter of reason and future competitiveness. Politicians and business need to finally agree on this and set the right course.

Our influence as a distribution industry is limited, but when it comes to innovations in electronics, we can bring all kinds of expertise to the table, from energy technology to artificial intelligence,” Steinberger concludes.