Chiplet market set to reach $411 billion by 2035

Chiplets break down complex chips into smaller, specialized components, giving greater flexibility and customization, resulting in faster time to market and shorter upgrade cycles.

The chiplet market is expected to reach USD 411 billion by 2035, driven by high-performance computing demands across sectors such as data centers and AI, according to a report by research firm IDTechEx.

The adoption of chiplets is rising fast thanks to the explosive growth of AI that’s putting increasing demands on servers, HPC and data centers.

A major benefit is that the various parts in a chiplet can take advantage of the newest fabrication methods and be shrunk in size, allowing more components to be squeezed in.

Chiplets break down complex chips into smaller, specialized components, giving greater flexibility and customization, resulting in faster time to market and shorter upgrade cycles.

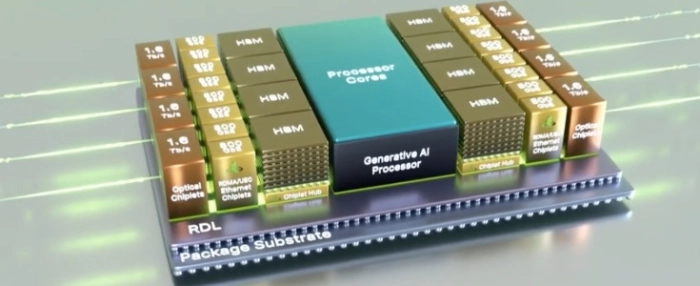

This modular approach allows manufacturers to integrate components customized to specific tasks, leading to versatile and efficient chips.

AMD’s EPYC processors and Intel’s Ponte Vecchio GPUs are examples of products that use chiplets.

Chiplet technology plays a crucial role in diverse sectors, including servers, telecommunications, PCs, mobile phones and automotive.

IDTechEx’s 10-year forecast considers the entire value of devices utilizing chiplet designs — such as CPUs, GPUs, HBMs, FPGAs, AI-ASICs, cache memory, flash storage, I/O controllers and optical I/O components — reflecting the key role of chiplets in improving performance and functionality.

“The nature of chiplets allows manufacturers to source different parts from multiple suppliers across various regions. This diversification reduces dependency on any single supplier or geographic area, thereby enhancing supply chain resilience,” the IDTechEx report says. “In the context of geopolitical tensions and trade restrictions, chiplet technology provides a strategic advantage by mitigating risks associated with supply disruptions.”