US extends semiconductor tax breaks to solar ingot and wafers

The Biden administration has finalized rules for a 25% tax credit for chip manufacturing projects, expanding eligibility for one of the largest incentive programs from the 2022 Chips and Science Act.

The US will extend a semiconductor manufacturing tax break to makers of solar wafers in another attempt by the Biden administration to bolster the domestic solar supply chain to further its clean energy and jobs agenda.

The government has finalized rules for a 25% tax credit for chip manufacturing projects, expanding eligibility for one of the largest incentive programs from the 2022 Chips and Science Act.

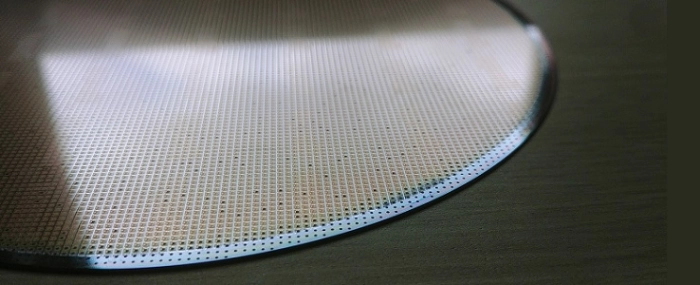

Solar wafers are thin silicon slices used to make solar panels, which are mostly produced in China.

Manufacturers have announced many new solar panel plants since 2022, thanks to new subsidies for clean energy manufacturing.

However, the US does not have ingot and wafer production in operation yet due to manufacturing complexities and the highly specialized equipment needed to create these facilities, making incentives an important part of the equation for wafer producers, according to a media release issued by the Solar Energy Industries Association (SEIA).

New rules for the 48D advanced manufacturing investment credit will allow solar ingot and wafer makers to claim a 25% tax break for new facilities.

Those facilities can also claim a separate manufacturing tax credit created by the 2022 Inflation Reduction Act.

“The Biden-Harris administration’s efforts will drive significant investment in domestic solar ingot and wafer manufacturing capacity, currently dominated by China, help meet our economic and national security goals, and support thousands of good-paying jobs across the country,” Mike Carr, executive director of the Solar Energy Manufacturers for America Coalition, said in a statement.

The tax refunds are one of three main subsidy streams available from the Chips Act, which also set aside USD 39 billion in grant funding and USD 75 billion in loans and loan guarantees.

“For the last two years, SEIA has been urging the administration to use all of the tools at its disposal to support ingot and wafer production. We commend the Treasury for taking a thoughtful approach to industrial policy, helping to revitalize our communities with great-paying manufacturing jobs and boost our energy independence," Abigail Ross Hopper, president and CEO of the SEIA, said. “This is a win-win for businesses and our economy and will continue the manufacturing renaissance in America for years to come.”