The state of the European EMS industry 2024

The European electronics industry has been grappling with a range of challenges for several years. Due to these challenges, different parts of the industry have been courted by policymakers and are now receiving support for further development, such as the semiconductor industry and the European Chips Act.

However, the industry consists of many interconnected parts, all of which depend on each other. During crises, focus typically shifts to the part deemed most critical at the time — like the semiconductor industry during the pandemic. But from a holistic perspective, several key segments within the EU's electronics industry are facing a decline, which could threaten Europe's security, industrial resilience, and global competitiveness.

A recent report by the IPC – together with Decision and In4ma – scrutinizes Europe's growing dependence on foreign regions for electronics manufacturing in critical and strategic sectors, including sectors such as aerospace and defence. Despite the introduction of the European Chips Act, the report — titled Securing EU’s Electronics Ecosystem — shows that the EU's market share in critical areas of the electronics industry, such as PCBs, electronics manufacturing services (EMS), and advanced packaging, are at risk of declining unless actions are taken. Evertiq has previously reported on the challenges facing the industry, particularly the PCB sector. This time we're shining the spotlight on the EMS providers

For this reason, Evertiq has invited Dieter G. Weiss, the founder of both Weiss Engineering and in4ma (Information for Manufacturers), as a keynote speaker during Evertiq Expo in Gothenburg on September 19, 2024, to provide a clearer picture of the situation — and the future. in4ma will also participate in Evertiq Expo Warsaw on October 24, 2024.

According to the report, a European strategy is required that takes a holistic approach, in contrast to the one-sided focus on the semiconductor industry that currently prevails. While semiconductors are undoubtedly important parts of electronic systems, one must not forget other critical parts of the electronics ecosystem – including PCB manufacturing and EMS. Therefore, the analysts advocate a "silicon to systems" strategy.

To highlight the extent of the risks, the report points out that Europe's share of PCB production has dramatically declined over the past two decades, and the region's share of electronics manufacturing is slipping. In 2000, Europe's domestic PCB production accounted for 13.8% of the global total; by 2022, this figure had dropped to 2.2%.

It's no secret that Europe is dependent on external manufacturing capacities, but what the report tries to convey is just how dependent Europe is on manufacturing outside the EU in eight strategic sectors – including aerospace and defence, automation, healthcare, mobility, renewable energy, security, and servers

A similar scenario is painted for each of these eight strategic sectors. Firstly, without strategic initiatives and guidelines, the EU’s total share of electronic system manufacturing is expected to decrease by 2035. Secondly, the EU remains heavily dependent on foreign suppliers for critical goods and processes such as PCBs, advanced packaging, and IC substrates. Thirdly, without well-planned and strategic interventions, these dependencies will escalate by 2035.

According to the data presented in the report, the EU's share of the global PCB industry is forecasted to decrease to 1.7% by 2035 if nothing is done to reverse the trend. A comparable scenario can be drawn for the manufacturing and assembly of electronic systems (OEM/ODM/EMS). The EU currently has a global market share of 16.6%, but as previously mentioned, if nothing changes, the IPC forecasts that this share will drop to 15% by 2035 within these eight sectors.

There is an imbalance in the various parts that make up the European electronics industry. In 2023, the EU produced PCBs worth EUR 1.37 billion, while the estimated demand was EUR 7.87 billion. This means that the production only covered 17.5% of the need. According to the report, this imbalance is particularly pronounced in sectors such as mobility and servers, HPC and supercomputing.

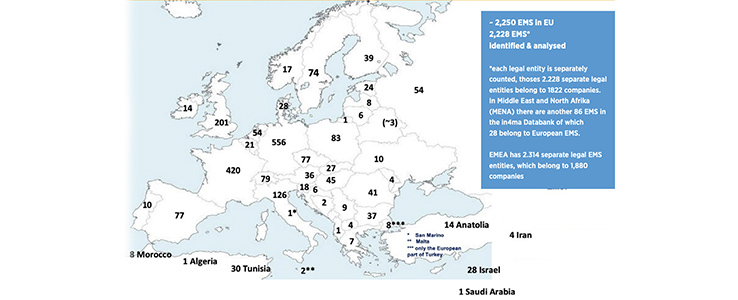

According to the report, there are approximately 2,250 EMS workers in the EU. Of these, 2,228 have been identified and analysed. Each legal entity is counted separately, and these 2,228 entities belong to 1,822 companies. In the Middle East and North Africa (MENA), there are a further 86 units in in4ma's database, out of which 28 belong to European companies.

These companies rely heavily on global supply chains for key electronic components, such as semiconductors and PCBs. Disruptions to these supply chains – as we saw during the pandemic – can have devastating effects.

The state of the European EMS industry 2024

During Evertiq Expo in Gothenburg, Dieter Weiss from in4ma will take the stage to give us an update on the situation for Europe's EMS providers. Nobody is talking about the chip crisis anymore. Are we back to normal??

According to Dieter Weiss, the answer is simple: "No, we definitely are not."The EMS industry is still suffering from the late effects of this crisis.

However, he argues that this crisis was all artificial but created a massive disruption for the industry — something he will explain in detail during his presentation.

Even today the EMS industry feels the pain of it with insufficient orders, excessive inventory and poor outlook. However, sometimes one must look back at unpleasant memories to get a clearer picture of what can be done to prevent this from happening again in the future.

The East-West difference of EMS companies in Europe

There are more than 1760 EMS companies in Western Europe but only about 400 EMS companies in Central Eastern Europe. Why is that? During Evertiq Expo Warsaw, Dieter G. Weiss and Dr. Mareike Haass from in4ma will explain the structure of this industry and its advantages and disadvantages. The experts will look at past developments and discuss future developments in EMS. What caused the product shifts and what are the reasons behind these developments?