Shipments to China limit revenue decline of top 5 WFE makers

The world’s top-five wafer fab equipment (WFE) manufacturers' revenue decreased 9% YoY in Q1 2024 due to delayed customer investments in leading-edge semiconductors, which were offset to some extent by strong DRAM demand.

Among these top five, ASML and Tokyo Electron’s revenues declined 21% YoY and 14% YoY respectively. Applied Materials, Lam Research and KLA’s revenues declined in low single digits when compared to 2023, reports research firm Counterpoint Research.

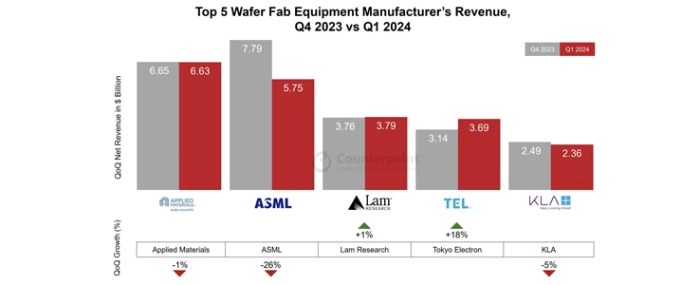

However, compared to the previous quarter, ASML's revenue fell 26% and KLA's revenue declined 5% due to a client capacity adjustment in the advanced node. Applied Materials and Lam Research's revenues were unchanged quarter on quarter, but Tokyo Electron's revenue increased by 18% due to high demand for both DRAM and NAND.

The top five WFE manufacturers' revenue from China surged 116% YoY in Q1 2024, owing mostly to higher DRAM shipments to the country. Strong demand from mid-critical and mature nodes across applications such as IoT, automotive, and 5G is expected to continue throughout the year.

The top five WFE manufacturers' memory revenue climbed 33% YoY in Q1 2024, thanks to increased NAND spending and robust DRAM demand from the growing popularity of AI. The foundry segment's revenue fell 29% YoY owing to delayed customer expenditures in leading-edge semiconductors.

“Revenue from memory increased significantly in Q1 2024, indicating the start of a turnaround in this segment and a stronger recovery in H2 2024. Despite short-term market uncertainties, we expect the recovery to continue in Q2 and likely pick up in H2. Though the Q1 order intake saw a decline from the previous quarter, we expect it to be healthy in the coming quarters on account of the recent US subsidies and ramp-up of 2nm technology in 2025. Looking ahead, AI is turning into a healthy technology transition and a top priority for chipmakers,” Senior Analyst Ashwath Rao says in a press release.

Rao continues to say that AI adoption in PCs, smartphones and servers will drive revenue growth for tool makers, while strategic investments may lead to slight gross margin adjustments in 2024. This sets the stage for a robust rebound in 2025 as the industry stabilises.

Increased sales to China in Q1 2024 offset revenue declines in other markets, Rao explains. China has increased its investment in DUV equipment in order to use it creatively for some of its leading nodes, such as multi-patterning processes. Chinese chipmakers are currently focused on expanding the country's chip production capabilities and fostering technological independence from external controls and Western suppliers.

2024 full-year revenue is forecast to grow at 4% compared to 2023, while the YoY revenue increase for 2025 is expected to be in double digits, with growth driven by capacity increases in leading-edge logic and foundry, applications including generative AI and high-performance computing (HPC), and the recovery in end-demand for chips.