Memory industry revenues to increase by 75% in 2024

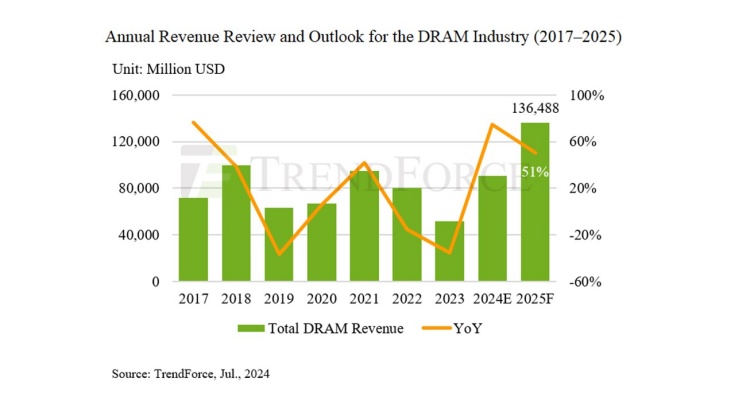

A new report by TrendForce predicts that DRAM and NAND Flash revenues are expected to rise by 75% and 77% respectively this year.

The industry analyst identifies four key factors driving the revenue growth of DRAM: the rise of HBM, the evolution of general DRAM products, restrained capital expenditures by manufacturers limiting supply, and the recovery in server demand. The HBM factor is especially important: compared to general DRAM, it boosts bit demand and raises the industry’s average price. HBM is expected to contribute 5% of DRAM bit shipments and 20% of revenue in 2024.

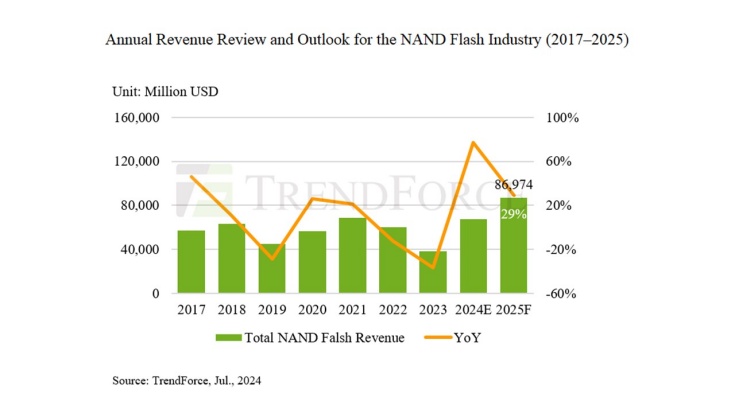

Meanwhile NAND Flash revenue will hit USD 67.4 billion in 2024, a 77% year on year increase. And Trendforce expects the buoyant market to persist through 2025, driven by the rise of high-capacity QLC enterprise SSDs, the adoption of QLC UFS in smartphones, restrained capital expenditures by manufacturers limiting supply, and the recovery in server demand. It is predicting NAND revenue to reach USD 87 billion next year, a 29% increase.

TrendForce also makes a few predictions about QLC. It estimates that QLC will contribute 20% of NAND Flash bit shipments in 2024, with this share expected to increase in 2025. In smartphone applications, QLC is expected to gradually penetrate the UFS market, with some Chinese smartphone manufacturers planning to adopt QLC UFS solutions starting in Q4 2024. Apple is anticipated to begin incorporating QLC into iPhones by 2026.