ST maintains top spot in revenue ranking for SiC power devices

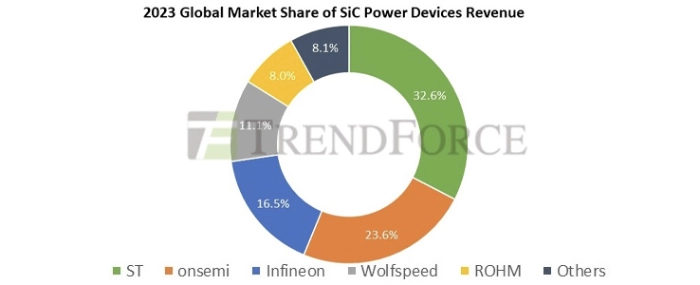

According to TrendForce, the SiC power devices market continued to display strong growth in 2023, driven by the use of BEVs. Roughly 91.9% of total revenue came from the top five suppliers; ST led the pack with a 32.6% market share, while Onsemi jumped from fourth place in 2022 to second place.

TrendForce’s analysis indicates that demand from AI servers and other fields will significantly increase in 2024. However, a marked slowdown in BEV sales growth and declining industrial demand are hurting the SiC supply chain. It is projected that the annual growth rate of industry revenue for SiC power devices will slow substantially in 2024 when compared to prior years.

ST, who is a major producer of automotive SiC MOSFETs, is establishing a full-process SiC facility in Catania, Italy, which is projected to be operational by 2026. Additionally, the 8-inch SiC joint venture facility formed by ST and Sanan Optoelectronics in China is expected to be operational by the end of this year. And as TrendForce points out, this will enable ST to achieve vertical integration by combining local post-processing production lines and supporting substrate material factories provided by Sanan Optoelectronics.

onsemi’s SiC business has progressed rapidly in recent years, mainly due to its automotive EliteSiC series.The company's SiC wafer plant in Bucheon, South Korea, completed its expansion in 2023 and intends to transition to 8-inch manufacturing after completing relevant technical verification next year. Since acquiring GTAT, Onsemi's self-sufficiency rate for SiC substrate materials has risen beyond 50%. With increased internal material production capability, the company is moving toward achieving a gross profit margin of 50%.

About half of Infineon's SiC revenue comes from the industrial sector, but the company's main client at the Kulim, Malaysia facility, SolarEdge, is facing challenges, which has affected Infineon's business operations. By comparison, Infineon's automotive business is growing more firmly, as seen by the company's recent design victory with the Xiaomi SU7. Interestingly, Infineon’s previously lagging capacity expansion progress now positions it favourably amid market headwinds. While Infineon aggressively promotes a varied supplier structure to maintain supply chain stability, it lacks internal manufacturing capabilities for SiC crystal materials, setting it apart from other top SiC IDMs.

Over the previous two years, Wolfspeed's operational strategy missteps have cost it market opportunities and resulted in setbacks for its power device business. However, Wolfspeed still has a first-mover advantage in the 8-inch domain and is the world's biggest supplier of SiC materials, especially for automotive-grade MOSFET substrates.

With Wolfspeed’s JP plant about to start production, it is expected to significantly increase material capacity and advance the progress of the Mohawk Valley Fab (MVF) plant’s commissioning. Despite this, Wolfspeed continues to confront high startup and idle capacity costs, which is straining its financial situation. The operational progress of the MVF and JP plans will determine whether Wolfspeed can smoothly navigate this.

ROHM recently acquired Solar Frontier's Kunitomi plant as its fourth SiC plant, with intentions to start producing 8-inch SiC substrates this year, followed by power devices. To increase its market share, the company has formed long-term partnerships with automotive companies and Tier 1 suppliers such as Vitesco Technologies, Mazda, and Geely, expediting the development of the next generation of power modules.

For more information visit TrendForce.