Wafer fab revenues fell 9% in Q1

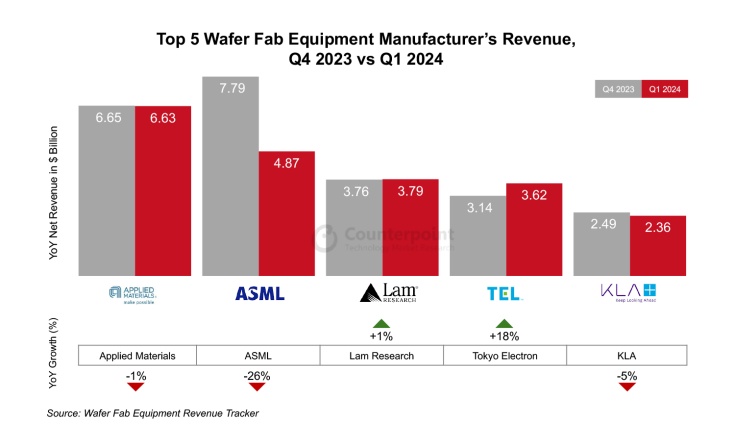

Sales for the the world’s top-five wafer fab equipment manufacturers’ decreased by 9% YoY in Q1 2024. This was due to delayed customer investments in leading-edge semiconductors, says new market data.

Research by Counterpoint has revealed that manufacturers were hit by short-term market uncertainties, but that revenues look set to recover in Q2 and the rest of the year – especially because of the impact of US state subsidies, the ramp-up of 2nm technology and the adoption of AI in PCs, smartphones and servers.

There was bad news in the DRAM space. Among the top five suppliers, ASML and Tokyo Electron’s revenues declined 21% YoY and 14% YoY respectively. Applied Materials, Lam Research and KLA’s revenues declined in low single digits when compared to 2023.

Revenue from China grew 116% YoY in Q1 2024, primarily due to increased DRAM shipments to the country. Counterpoint believes strong sales will continue thanks to demand for mid-critical and mature nodes across applications including IoT, automotive and 5G will likely continue for the rest of the year.

Senior Analyst Ashwath Rao said, “Looking ahead, AI is turning into a healthy technology transition and a top priority for chipmakers. AI adoption in PCs, smartphones and servers will drive revenue growth for tool makers, while strategic investments may lead to slight gross margin adjustments in 2024. This sets the stage for a robust rebound in 2025 as the industry stabilises.”