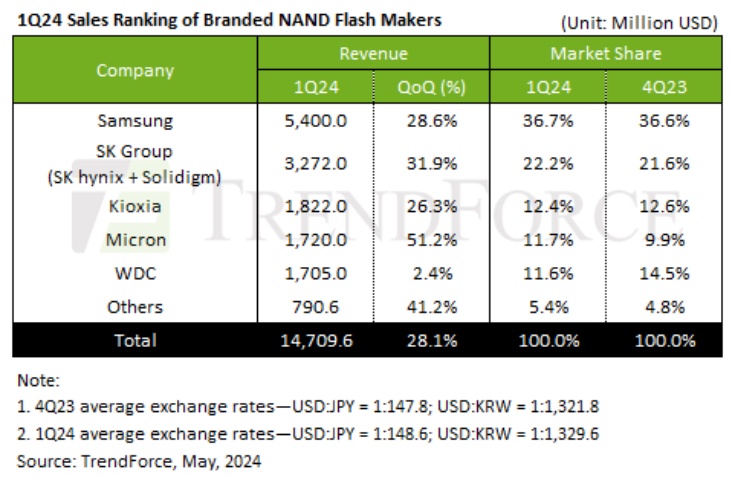

NAND flash revenue grew by 28.1% in 1Q24

New data from TrendForce has revealed a bumper quarter of growth in the NAND memory sector – and it is projecting another burst of growth in Q2.

The research says demand was driven by the adoption of enterprise SSDs by AI servers in February, and by PC and smartphone OEMs increasing their inventory levels to manage rising prices. This boosted quarterly revenue by 28.1% to USD $14.71 billion.

In terms of company rankings, Samsung and SK hynix stayed at the top. Samsung maintained its market leadership with 36.7% of all sales, while SK captured 22.2%. However, there was movement below them, with Micron overtaking Western Digital to secure fourth spot. Micron posted 51.2% QoQ revenue growth to claim 11.7% of market sales.

TrendForce reports that PC and smartphone customers have already raised their NAND Flash inventory levels for Q2. Meanwhile, the surge in large enterprise SSD orders continues to drive up the ASP of NAND Flash by 15%. TrendForce forecasts Q2 NAND Flash revenue to increase by nearly 10% QoQ.