NAND and DRAM contract prices set to increase even more

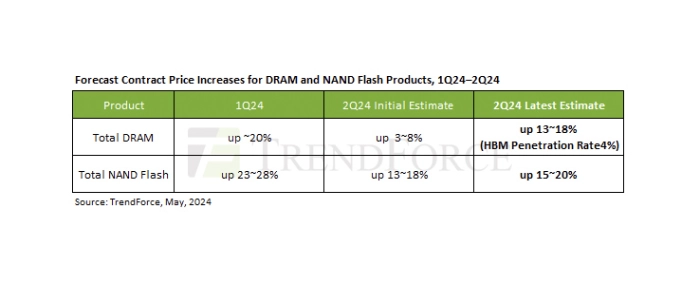

TrendForce’s latest forecasts reveal contract prices for DRAM in the second quarter are expected to increase by 13–18%, while NAND Flash contract prices have been adjusted to a 15–20%. Only eMMC/UFS will be seeing a smaller price increase of about 10%.

Before the 4/03 earthquake, TrendForce had initially predicted that DRAM contract prices would see a seasonal rise of 3–8% and NAND Flash 13–18%, significantly tapering from Q1 as seen from spot price indicators which showed weakening price momentum and reduced transaction volumes.

This was primarily due to subdued demand outside of AI applications, particularly with no signs of recovery in demand for notebooks and smartphones. Inventory levels were gradually increasing, especially among PC OEMs. Additionally, with DRAM and NAND Flash prices having risen for 2–3 consecutive quarters, the willingness of buyers to accept further substantial price increases had diminished.

Post-earthquake, the market heard scattered reports of PC OEM suppliers accepting significant increases in DRAM and NAND Flash contract prices due to special considerations, but these were isolated transactions. By late April—after a new round of contract price negotiations were completed — the increases were larger than initially expected. This pushed TrendForce to revise upward Q2 contract price increases for both DRAM and NAND Flash, reflecting not only the buyers’ desire to support the value of their inventories but also considerations of supply and demand prospects for the AI market.

TrendForce reports that manufacturers are wary of potential crowding out effects on HBM capacity. Specifically, Samsung’s HBM3e products, which utilise the 1alpha process node, are projected to use about 60% of this capacity by the end of 2024. This substantial allocation is expected to constrict DDR5 suppliers, particularly as HBM3e production significantly increases in Q3. In response, buyers are strategically increasing their stock in Q2 to prepare for anticipated HBM shortages beginning in the third quarter.