300mm fab equipment spending to reach new highs in 2027

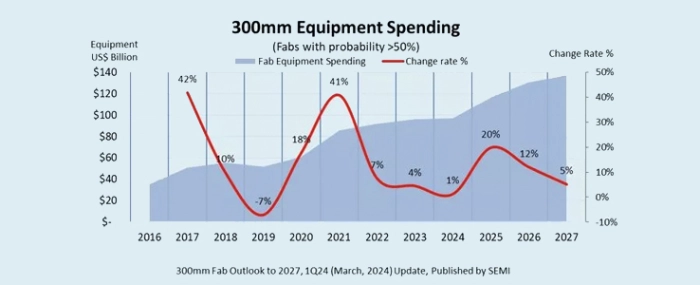

Global 300mm fab equipment spending for front-end facilities is forecast to reach a record USD 137 billion in 2027 after topping USD 100 billion for the first time by 2025, reports SEMI

The increase is driven by the memory market recovery and strong demand for high-performance computing and automotive applications.

Global investment in 300mm fab equipment is expected to increase by 20% to USD 116.5 billion in 2025 and 12% to USD 130.5 billion in 2026, before reaching a new record high in 2027.

“Projections for the steepening ramp of 300mm fab equipment spending in the coming years reflects the production capacity needed to meet growing demand for electronics across a diverse range of markets as well as a new wave of applications spawned by artificial intelligence (AI) innovation,” said Ajit Manocha, SEMI President and CEO in a press release.

The CEO continues to say that the report also highlights the critical importance of increases in government investments in semiconductor manufacturing to bolster economies and security worldwide.

“This trend is expected to help significantly narrow the equipment spending gap between re-emerging and emerging regions and the historical top-spending regions in Asia.”

From a regional standpoint, China stands out, continuing to lead fab equipment spending with USD 30 billion in investments in each of the next four years – fuelled by government incentives and domestic self-sufficiency policies.

Taiwanese and Korean chip makers are boosting their equipment investments, owing to the rise of leading-edge nodes for high-performance computing (HPC) and the recovery of the memory market. Taiwan is anticipated to rank second in equipment spending in 2027, with USD 28 billion, up from USD 20.3 billion in 2024, and Korea comes in third, with USD 26.3 billion in 2027, up from USD 19.5 billion this year.

The report projects that the Americas will double 300mm fab equipment investments from USD 12 billion in 2024 to USD 24.7 billion in 2027, while spending in Japan, Europe & the Middle East, and Southeast Asia are expected to reach USD 11.4 billion, USD 11.2 billion, and USD 5.3 billion in 2027, respectively.

SEMI says that its report lists 405 facilities and lines globally, which includes 75 high-probability facilities expected to start operation during the four years beginning in 2024. The report also reflects 358 updates and 26 new fabs/lines projects since its last edition in December 2023.