What is the future for SiC in Europe?

To understand the – potential – future, we first must look at the present and the ongoing movement. Therefore, Evertiq invited Yole Group as a keynote speaker during its inaugural Expo in Sophia Antipolis, France dig deeper into the market, investments and competitive landscape of SiC.

The power electronics industry is an interesting market and one in constant development. However, it was negatively impacted by the COVID-19 pandemic, mainly due to supply chain disruptions, company shutdowns, and lower production rates, especially in the traditional automotive business.

“Electric vehicles, or EVs, is a very important topic in Europe. As of today, this is the main market driver for silicon carbide and for what will happen in the coming five years,” those were the opening words of Poshun Chiu, Senior Analyst at Yole Group, as he took to the stage during Evertiq Expo in Sophia Antipolis to provide us with an overview and forecast of the power SiC market.

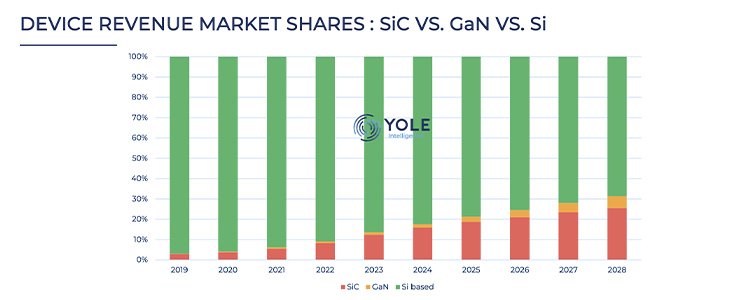

Silicon is found everywhere in every product, but today we are seeing two different technologies coming. One is Silicon Carbide (SiC), which lends itself to high-power applications, the other is Gallium Nitride (GaN) which lends itself to applications requiring higher frequency, but on a lower power level than SiC.

Today we have seen the entry of SiC in the automotive industry, mainly via EVs, but also in railway and in photovoltaic (PV) inverters – however the future holds much more promise for the technology.

“In the coming five years, by 2028, we expect SiC device revenue to represent more than 25.5% of the semiconductor power market, with GaN device revenue comprising around 6%,” Poshun Chiu told the audience at the expo.

By the end of this year, Yole expects SiC to represent 15% of the semiconductor power market, which means that it’s actually quite significant. Because in general, if something can be done with silicon, companies will choose silicon – so the question is, why choose SiC?

According to Poshun, SiC devices provide very high conversion efficiency and extend the car's range. This all means that the expectations for the utilisation rate of SiC within the automotive industry are very high.

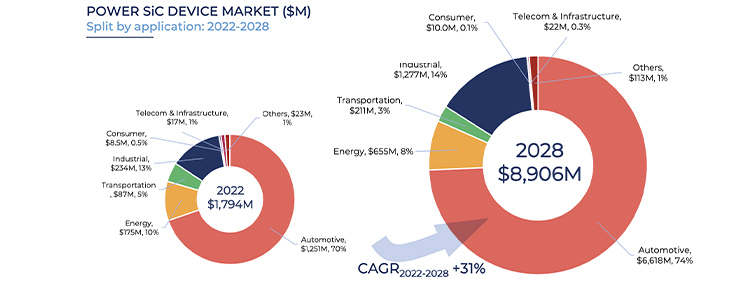

To back up the statement, Poshun shared distribution data from past years. In 2021, the Power SiC industry already boasted a market value of USD 1.1 billion, the following year it had increased to USD 1.8 billion – and it continues to grow. Even though there were concerns over the past years regarding the shortage of SiC substrate, Yole is seeing more and more suppliers emerging – which is set to match the growth. As of 2024, SiC is a multiple billion dollar business, and by Yole's prediction, it will grow to USD 10+ billion by 2030.

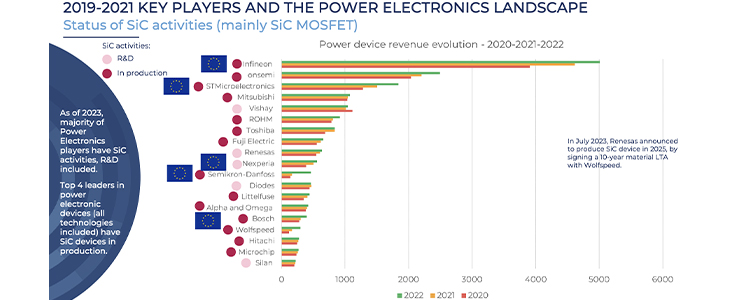

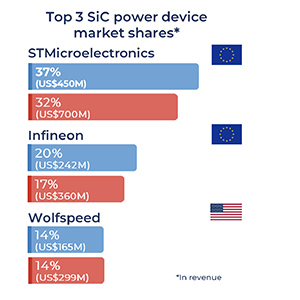

Poshun continued to show the top three players in the power device market based on revenue (from 2022), and two European companies held the top positions. STMicroelectronics holds the pole position while Infineon comes in as the runner-up. For the third position, we have to go across the Atlantic to US-based Wolfspeed. However, in Yole’s estimate for 2023, OnSemi will take the number two spot.

Right now automotive applications dominate the SiC market due to the strong electrification trend, representing 70% of the Power SiC market in 2022. However, the power SiC device market is forecast to grow nearly to USD 9 billion with continuing penetration of SiC in automotive, along with industrial applications.

“So over the next five years, we are expecting a growth rate of more than 30%. And is quite significant to have a 30% growth rate every year to 2028, reaching almost USD 9 billion.”

Poshun continues to say that it will be an interesting journey to follow. Usually, when we see a market growing, more applications will enter to assess the technology – however, automotive is and will stay the main market driver. And considering the movement within the automotive industry – with the electrification of entire fleets – the volume is expected to be quite significant.

Since 2017, Tesla has been using SiC devices from STMicroelectronics, which is a major reason for the growth. Since then it’s been a domino effect and more and more carmakers and brands have chosen the SiC route.

As of 2023, SiC has been adopted in the main inverter of premium cars with 400V and 800V batteries. Also, SiC has already been adopted in onboard chargers. Some high-end sports EVs also adopted SiC for performance and system downsizing requirements. The adoption of SiC in BEVs is poised to grow, mainly in the 800V BEV segment.

Key players and power electronics landscape

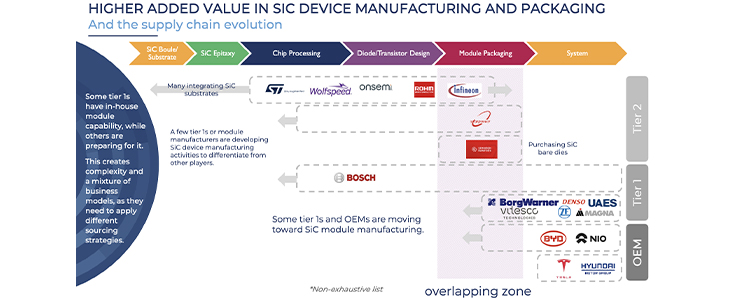

As of 2023, the majority of power electronics players have ventured into SiC activities, R&D included. Today, the top four leaders in power electronic devices (all technologies included) have SiC devices in production.

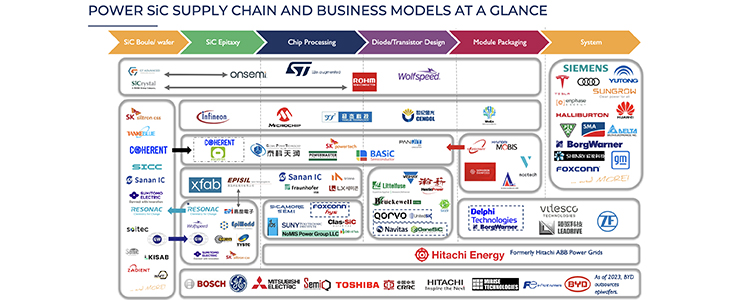

In the coming years, several 8” SiC facilities are either being developed/built or are ramping up production – globally. So what about Europe?

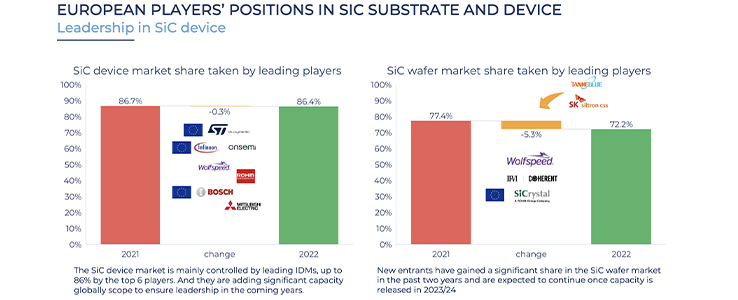

Well, Europe is strong, with a lot of activities at a device level, but not so much at the substrate level. The real strength of the European players, besides the accumulated knowledge, is that they have their own device processing and packaging. Yole Group Ranks European companies high, meaning that in terms of competitiveness, European SiC companies stand quite strong.

The SiC device market is mainly controlled by leading IDMs, up to 86% by the top six players, three of which are European. And they are adding significant capacity on a global scope to ensure leadership in the coming years.

Poshun brings up both ST and Infineon to illustrate how their strategies are fortifying their position in the market. ST for instance acquired Swedish SiC wafer company Norstel back in 2019 to internalise SiC water capability. The company has also been qualifying engineered SiC substrate, SmartSiC, from Soitec to expand its base.

Recently, ST also entered into a joint venture with Sanan in China. This will allow the company to manufacture power devices in China under the banner of a Chinese company – for the Chinese market. So that means ST is becoming Chinese in China to support the customers that they have already. The move is described as “super smart”, as ST will be considered a Chinese company in China – which means that they will not be pushed out by other Chinese suppliers because they “are” a Chinese supplier.

Infineon on the other hand are not engaged in substrates, so it acquired Siltectra and its wafering technology, Coldsplit back in 2018. The company has been betting big on securing supply and has signed long-term agreements with multiple suppliers, to build a more resilient supply of SiC wafers/epiwafers.

However, as Poshun points out, in order to secure the leadership, major European IDMs are now expanding capacity to the US and Asia.

Evident is that SiC is on the move, and as Poshun pointed out earlier in his presentation, by 2028, Yole expects SiC device revenue to represent more than 25.5% of the semiconductor power market.

Data and images © Yole Group