AI chip deals remain low; chip makers take over as major buyers

New research from Omdia reveals that while demand for AI chips is soaring, AI chip deals remain low – and that chip manufacturers are taking over as the major buyers.

The information stems from the second edition of Omdia’s AI Processors Mergers & Acquisitions Tracker, a six-monthly tracker that monitors mergers and acquisitions activity involving a core group of major technology companies involved in AI infrastructure and silicon globally.

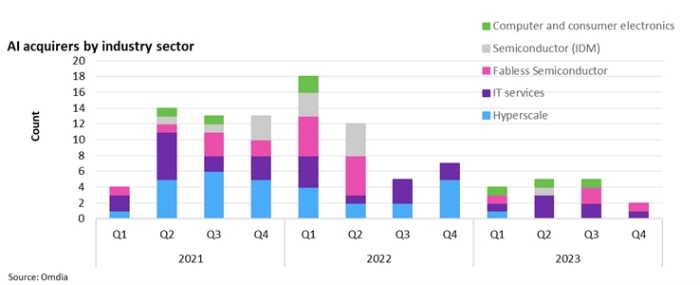

Omdia states that activity remains low compared to the boom during 2021, with a shift from hyperscale to semiconductor companies as the main buyers. There was only one acquisition involving a hyperscaler in 2023, during 1Q, compared with 17 in 2021. However, the most common deal is still a hyperscaler buying a software applications company. However, Omdia states that the market is gradually internationalising, with the fraction involving companies entirely outside the US slightly increasing.

AI acquirers by industry sector

“On a company basis, IBM is the biggest buyer and is maintaining a steady cadence of around one acquisition every quarter. In this edition, we observe that Big Blue’s focus has shifted from services and specifically consulting companies to software, while Microsoft – once the biggest acquirer – has stopped entirely in 2023. Apple, which has been keeping its powder dry, has returned to the market with three bids in 2023, the first since 1Q 2022,” says Omdia’s Principal Analyst for Advanced Computing, Alexander Harrowell in a press release.

Mr Harrowell continues to say that so far, we haven't seen many exits among the AI hardware startups that were funded starting in 2018-2019, although they've struggled to make headway against Nvidia.

"The historic scale of VC funding during 2021 means many of them still have a substantial war chest, although once one goes, more might follow.”